Are you a brand looking to establish your retail presence in Delhi? But need to pinpoint the exact localities & pincodes that truly matter based on buying demand?

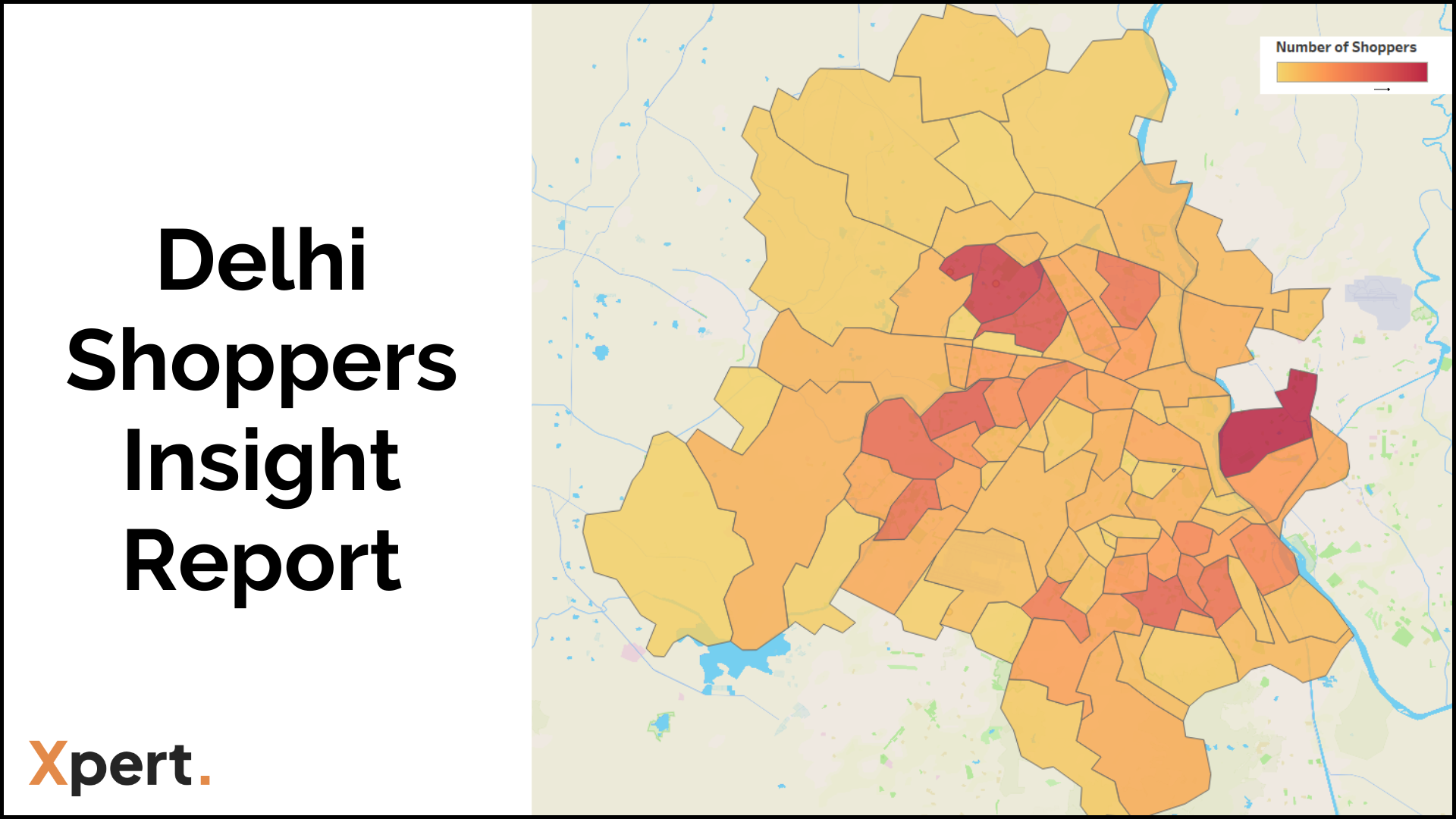

While census data highlights population density, it doesn’t reflect buying density. Given that <5% of Indians account for >95% of discretionary purchases, relying on population data alone can lead to misallocations.

Insights from sales teams and competitor locations help, but they are often based on intuition rather than hard data. To make truly strategic decisions, you need insights directly linked to your actual buyers. What if you could base your Delhi retail strategy on real buyer behavior rather than guesswork?

That’s exactly why we created Xpert’s Delhi Buyers Insight Report 2024—a data-driven analysis that reveals where, what, and how Delhiites shop, enabling brands to make informed expansion decisions.

Our data source?

We tracked over 275K buyers making both online and in-store purchases across 300+ brands to uncover WHERE they are concentrated and WHAT they are buying!

The report goes beyond footfall metrics—it delivers actionable locational insights to help brands maximize store performance. Stop relying on guesswork and start making data-driven expansion moves!

What You’ll Discover in the Xpert Delhi Buyers Insight Report:

- Where should you expand next? – Identifying the most profitable markets and pincodes for new store openings.

- Which 14% of pincodes house over 40% of Delhi’s active buyers? – Focusing on high-impact areas with concentrated buyer activity.

- Which malls attract the most buyers? – Discover top retail hubs that drive high footfall and conversion.

- Which zones have the highest revenue potential? – Align your expansion strategy with buyer density and spending power.

- What are Delhiites buying? – Understand their spending habits and preferences to optimize inventory.

Delhi Buyers: The Surprising Insights

One of the biggest revelations? Only 14% of Delhi’s pincodes house over 40% of its active buyers!

Even more surprising? A significant chunk of these buyers are concentrated in just a few key localities. Imagine knowing exactly which areas drive the majority of retail demand—this kind of hyper-local insight is invaluable for retail heads looking to optimize store placement and marketing strategies.

What Are Delhiites Buying?

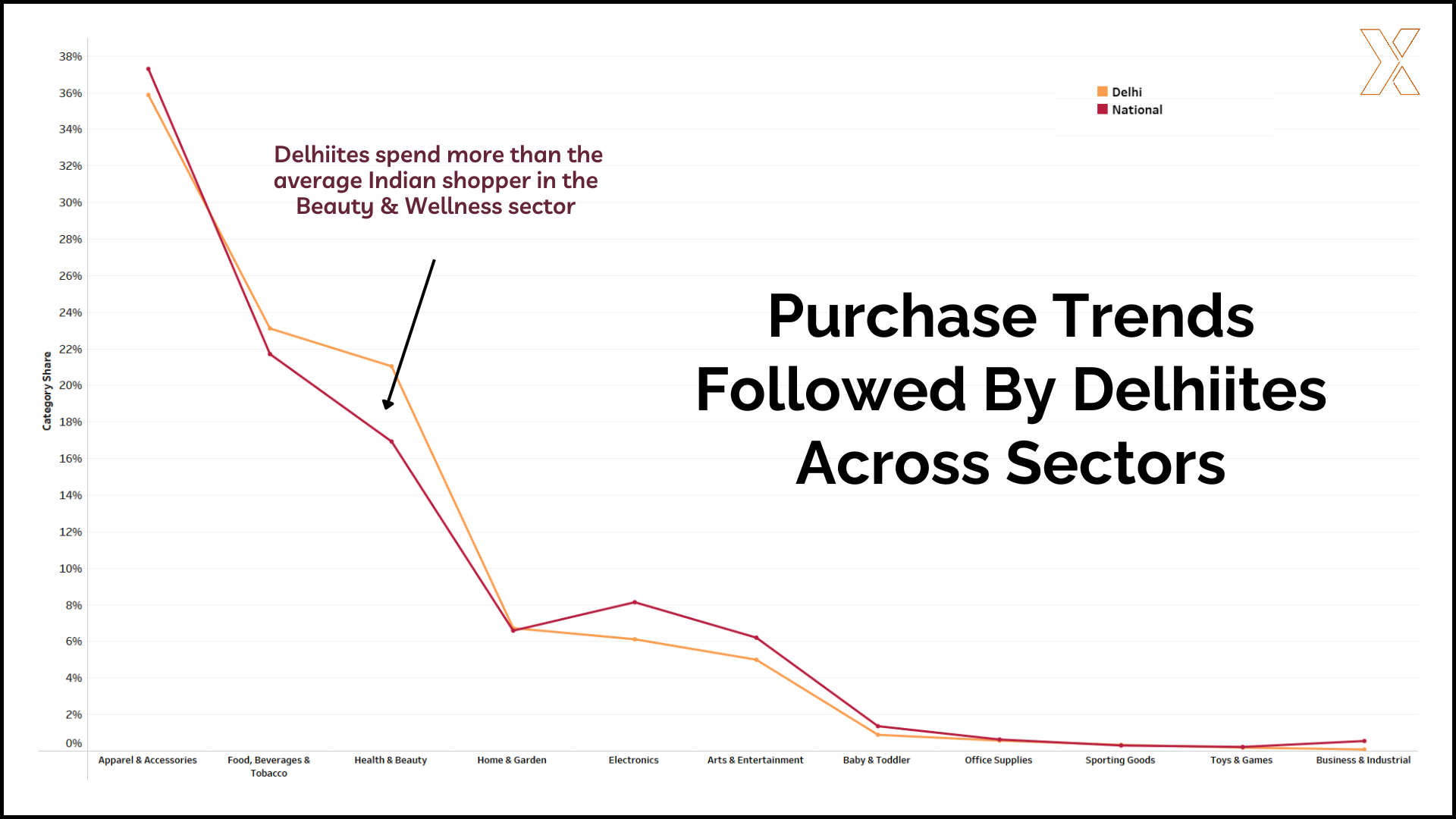

Compared to the national average, Delhi’s buyers show distinct shopping habits:

By understanding these preferences, brands can optimize their product assortment and pricing strategy to maximize conversions.

- Higher Spending on Beauty & Wellness: Delhiites allocate more of their budget to these categories compared to the average Indian shopper.

- Premium & Luxury Preference: Despite widespread access to budget-friendly options, Delhiites surpass the average buyer in premium & luxury purchases.

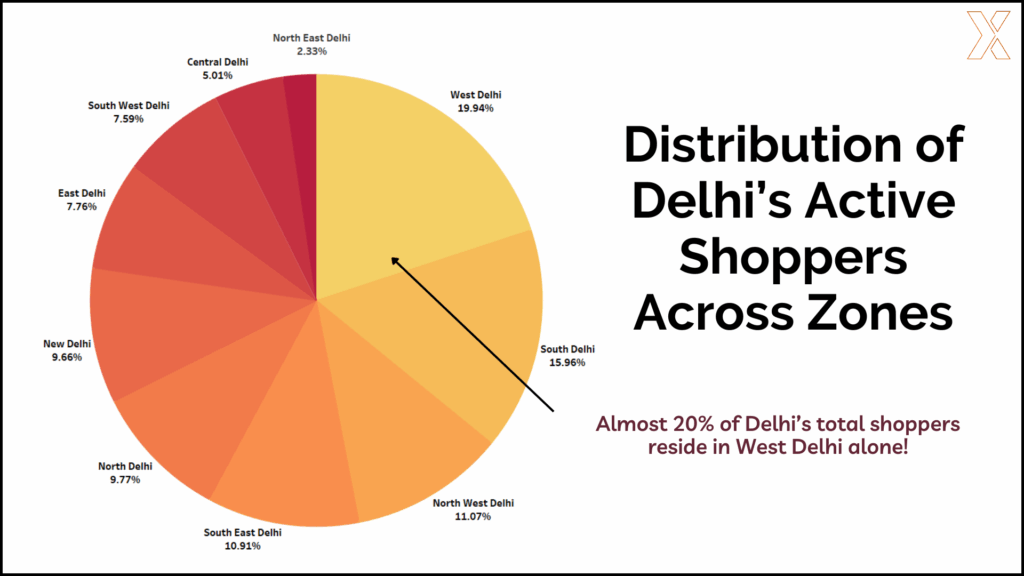

Where Are Delhi’s Active Shoppers Located?

Want to avoid wasting money opening a store in a dead zone? This data helps you avoid bad locations and focus on high-revenue areas.

- West Delhi dominates with nearly 20% of total shoppers—making it the most concentrated shopping zone. If you’re a retail brand, West Delhi should be your top priority for store openings, marketing campaigns, or activations. South Delhi is another high-impact area, while zones like North East Delhi may not be as lucrative for immediate expansion.

- South Delhi follows with 15.96%, indicating strong buyer activity.

- North West Delhi (11.07%) and South East Delhi (10.91%) also have a significant share of shoppers.

- Central Delhi (5.01%) and North East Delhi (2.33%) have the lowest concentration of active buyers.

If you’re looking to expand or target promotions in West Delhi, these locations should be at the top of your list driving retail sales.

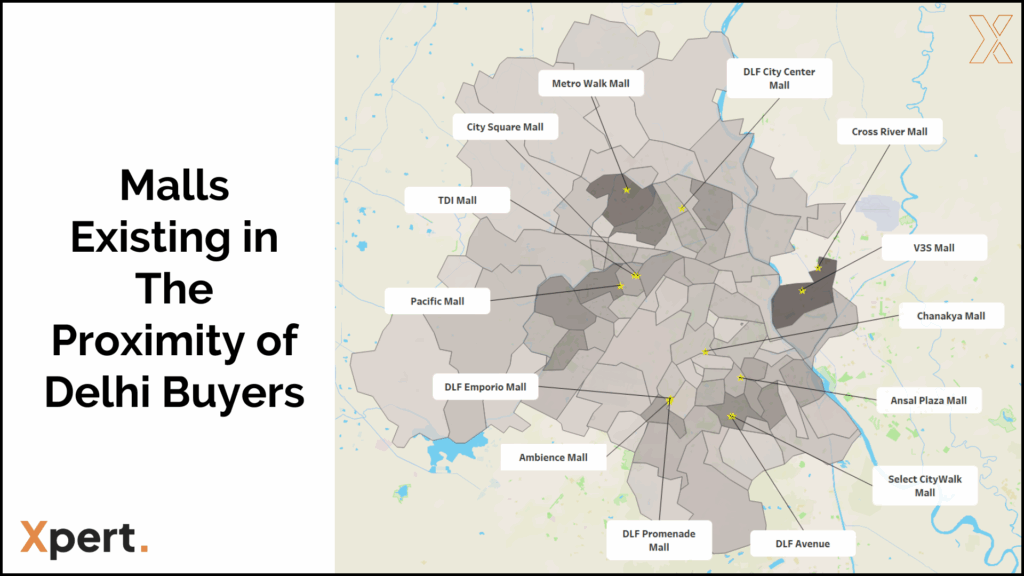

Where Do Delhiites Prefer to Shop?

Delhi’s retail landscape is dominated by malls, offering a mix of convenience, climate control, and brand variety. But not all malls perform equally in terms of actual conversions.

For instance, areas like Malviya Nagar and Saket, home to Nexus Select City Walk and DLF Avenue, attract a high percentage of buyers. Understanding the buyer distribution in these localities ensures your retail activations, store launches, and marketing efforts are strategically placed for maximum impact.

How This Report Solves Your Retail Challenges

This isn’t just another data dump—it’s a strategic playbook designed to solve real-world retail dilemmas:

- Pinpoint profitable locations with high growth potential.

- Eliminate locational blindspots & validate where to open your next store.

- Optimize marketing budgets by focusing on areas with high buying potential.

- Identify untapped vs. saturated locations for smarter expansion decisions.

Ready to transform your retail strategy?

Discover Delhi’s most lucrative retail opportunities for your next big expansion.

And if you’ve ever spent hours stuck in Delhi traffic just to reach a market that turns out to be a dud, you’ll know why getting these insights in advance is a lifesaver.

About Xpert

At Xpert we track omni-channel purchases across 12M+ Indians to help brands better target their marketing & scale their distribution.

Leveraging our data brands are able to optimize their marketing spends, strategically scale their retail expansion & identify demand blindspots.

Here’s more about us : www.xpert.chat