Looking to scale your healthcare brand’s footprint across India—but unsure which cities, areas, and stores actually drive premium healthcare purchases?

While demographic data highlights regions with high population, it doesn’t reflect where the actual premium healthcare spend is happening. In fact, less than 5% of Indians account for the majority of premium wellness and healthcare purchases—proving once again that Population ≠ Purchase Behavior.

That’s why Xpert created the Premium Healthcare Buyers Report 2025—a purchase-based deep dive into where India’s most valuable health-conscious consumers are concentrated, and what they care about.

Based on Real Purchase Data—Not Guesswork

We analyzed over 2.2 million premium healthcare buyers, spanning 500+ omni channel brands across 19,000+ Indian pincodes. We mapped actual buyer journeys—across digital and retail—to decode:

- Where India’s top healthcare spenders live and shop

- The most buyer-dense areas, down to pincode and locality

- How healthcare preferences vary by city, tier, and affluence

- What other categories premium healthcare buyers also shop for

And the results? They reveal a clear pattern of concentration—and actionable insights for brands.

Key Insight: India’s Premium Healthcare Demand Is Highly Clustered

Premium healthcare buyers are not evenly spread across cities. They are heavily concentrated in fewer areas, which is why relying on population heat maps or competitor presence can lead to inefficient retail and media spends.

Across Tier 1 cities, 80% of all premium healthcare purchases come from just 24% of areas.

Let’s break it down:

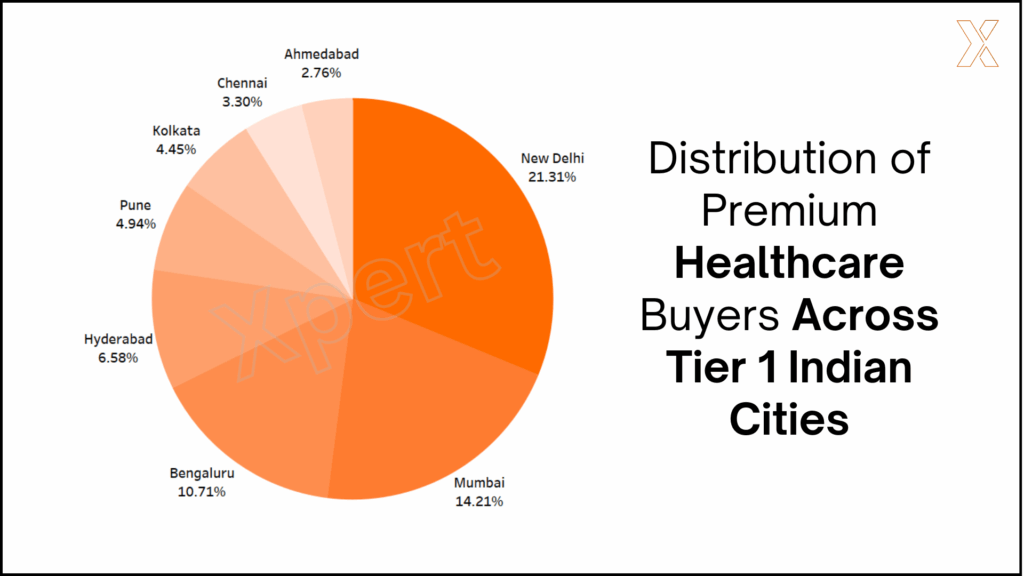

Where Are India’s Premium Healthcare Buyers Located?

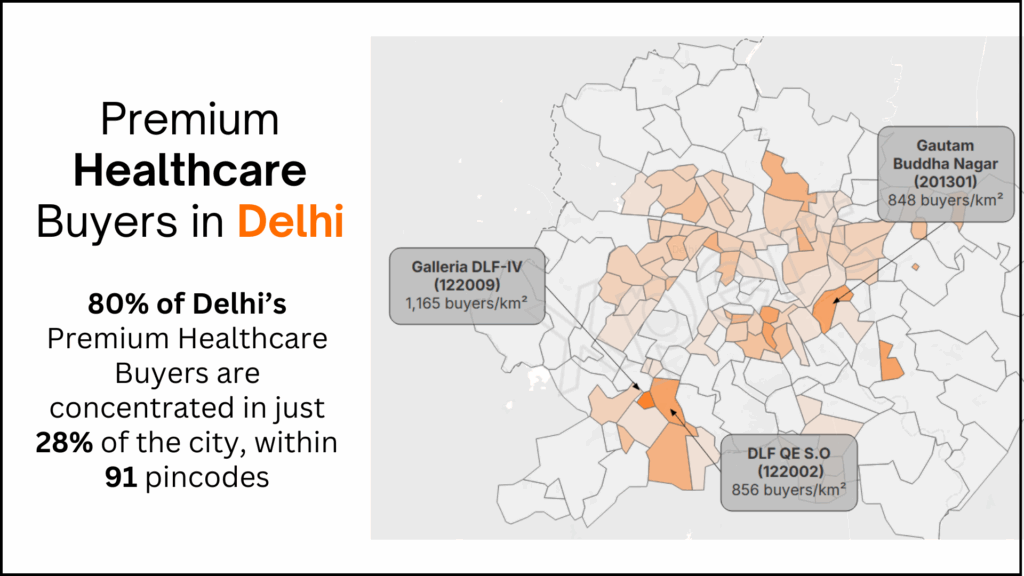

Delhi NCR

In Delhi NCR, 80% of premium healthcare purchases are concentrated in just 28% of the city, across 91 high-density pincodes.

Top Pincodes by Buyer Count:

- 201301 (Noida) – 5.43%

- 122001 (Gurgaon) – 4.22%

- 122002 – 2.90%

These are ideal locations for store expansion, clinic openings, and local performance marketing.

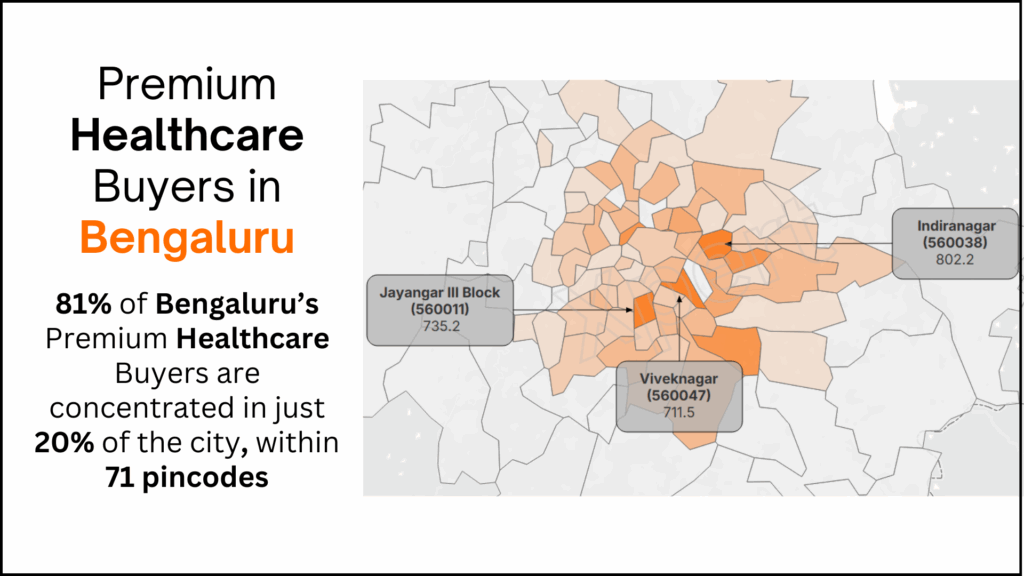

Bengaluru

Bengaluru’s premium healthcare buyers are 81% concentrated in just 20% of the city, across 71 key pincodes.

Top Pincodes by Buyer Count:

- 560076 – 4.01%

- 560037 – 3.75%

- 560043 – 3.72%

Whether you’re planning a product launch or a new clinic, these are Bengaluru’s healthcare hubs.

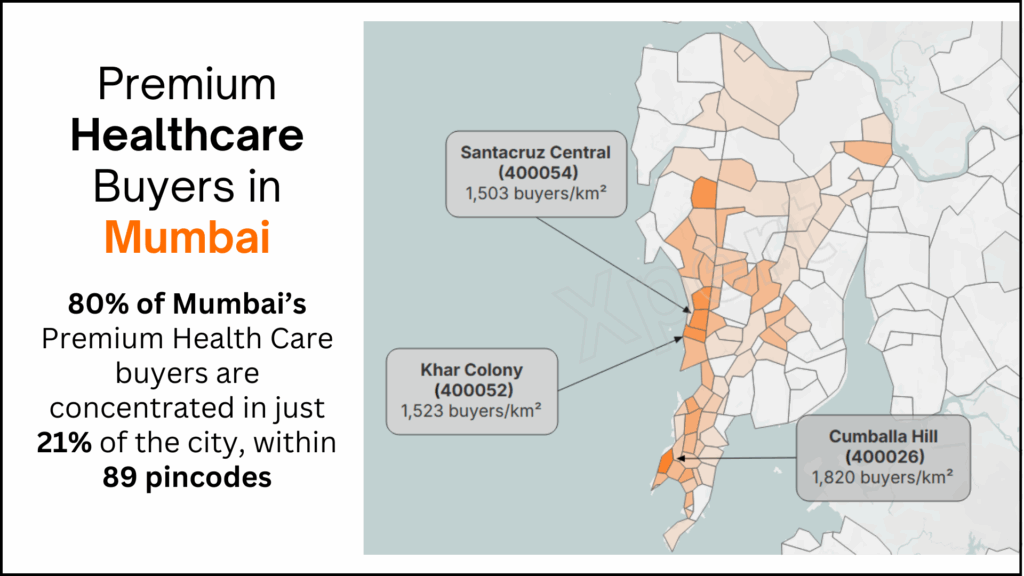

Mumbai

Mumbai shows similar trends, with 80% of healthcare purchases concentrated in just 21% of the city, across 89 pincodes.

Top Pincodes by Buyer Count:

- 400053 – 3.47%

- 401107 – 2.81%

- 400050 – 2.27%

These insights help brands avoid broad, low-conversion targeting and double down on high-intent zones.

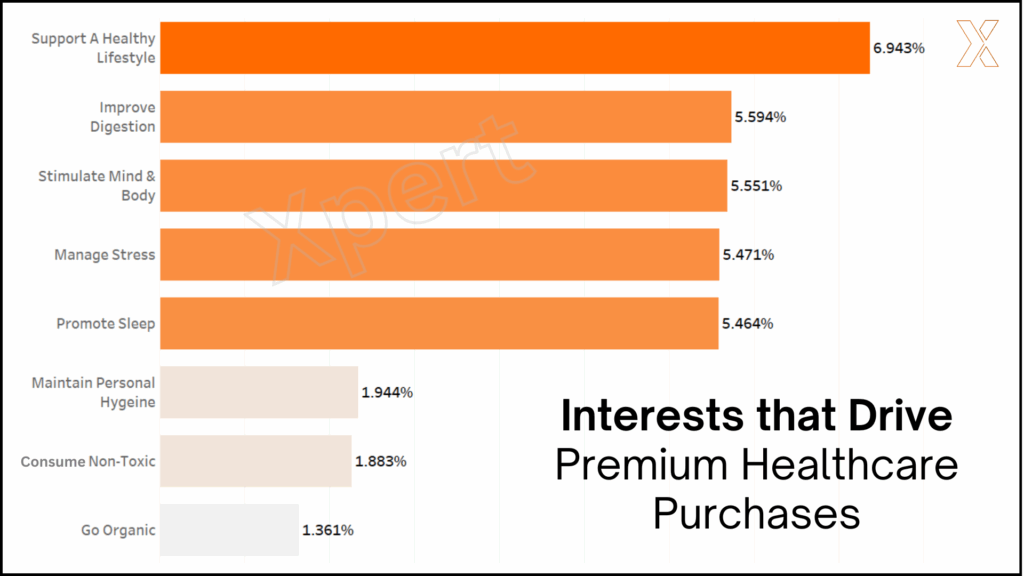

Why Are Healthcare Purchases Being Made?

Premium healthcare buyers in India aren’t just reacting to illness—they’re actively investing in products that help them feel, function, and live better every day.

Xpert’s purchase analysis reveals that healthcare consumption is primarily being driven by:

- Supporting a Healthy Lifestyle – Buyers are making consistent choices that align with fitness, immunity, and long-term wellness goals.

- Improving Digestion – Digestive health solutions are seeing strong traction, reflecting a focus on gut wellness and dietary optimization.

- Stimulating Mind and Body – Products that boost energy, focus, and mental clarity are gaining popularity, particularly among working professionals.

- Managing Stress – With rising awareness around mental health, consumers are turning to calming supplements and wellness aids to reduce stress and anxiety.

This shift highlights a movement from reactive treatment to proactive, holistic health management, creating powerful opportunities for brands across diagnostics, supplements, and wellness retail.

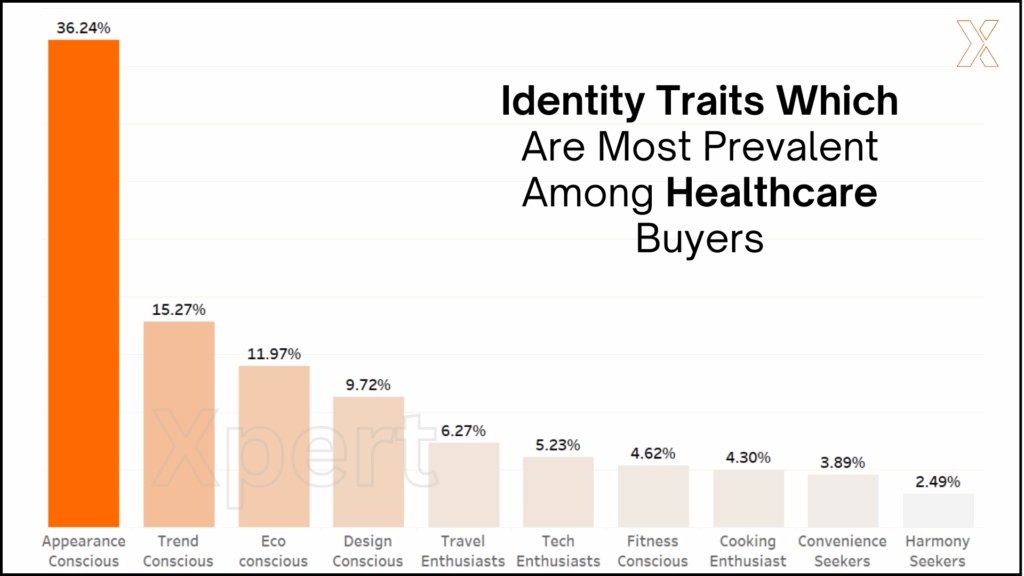

Which Identity Traits Are Most Prevalent Among Healthcare Buyers?

Based on actual cross-category behavior, Xpert identified the identity traits that are most common among premium healthcare shoppers. These consumers tend to be:

- Appearance Conscious – Their interest in personal grooming and fitness often extends into their health choices, particularly products that impact physical vitality.

- Design Conscious – They are selective about brand aesthetics, thus more likely to prefer healthcare products that offer sleek packaging and premium presentation.

- Eco Conscious – Environmental values matter—they often choose brands that align with sustainable practices or offer clean, natural ingredients.

- Trend Conscious – Quick to adopt new formats, ingredients, and global trends, they are influenced by modern wellness culture and digital buzz.

These identity signals help brands not only define what to sell, but also how to position it—ensuring higher resonance with their best-fit audience.

What Else Are Healthcare Buyers Shopping?

Our data reveals that premium healthcare buyers are also active purchasers in:

- Apparel

- Food & Beverage

- Home Decor

This overlap allows brands to build richer audience profiles and run cross-category marketing strategies that mirror real customer interests.

How Can You Act On This?

At Xpert, we help brands take guesswork out of their growth strategy. Our data helps you:

- Reach buyers where actual purchases happen

- Discover untapped markets with high buyer density

- Plan smarter retail and media strategies for healthcare categories

Download the full Premium Healthcare Purchases Report 2025

About Xpert

At Xpert, we help India’s leading retail brands, malls, and media teams grow smarter by tracking 12M+ verified buyer journeys across 500+ omnichannel brands.

From catchment evaluation to buyer-led expansion strategies, we help you:

- Target high-conversion zones

- Launch where the demand lives

- Build your next store, not just in the right city—but in the right neighborhood

Explore more at www.xpert.chat