Most marketers believe they’re running hyperlocal campaigns. City-level targeting, top malls, high-footfall zones—it all sounds like precision. But dig deeper, and a stark reality emerges: most brands are still targeting where people live, not where people buy.

At Xpert, we set out to challenge that assumption.

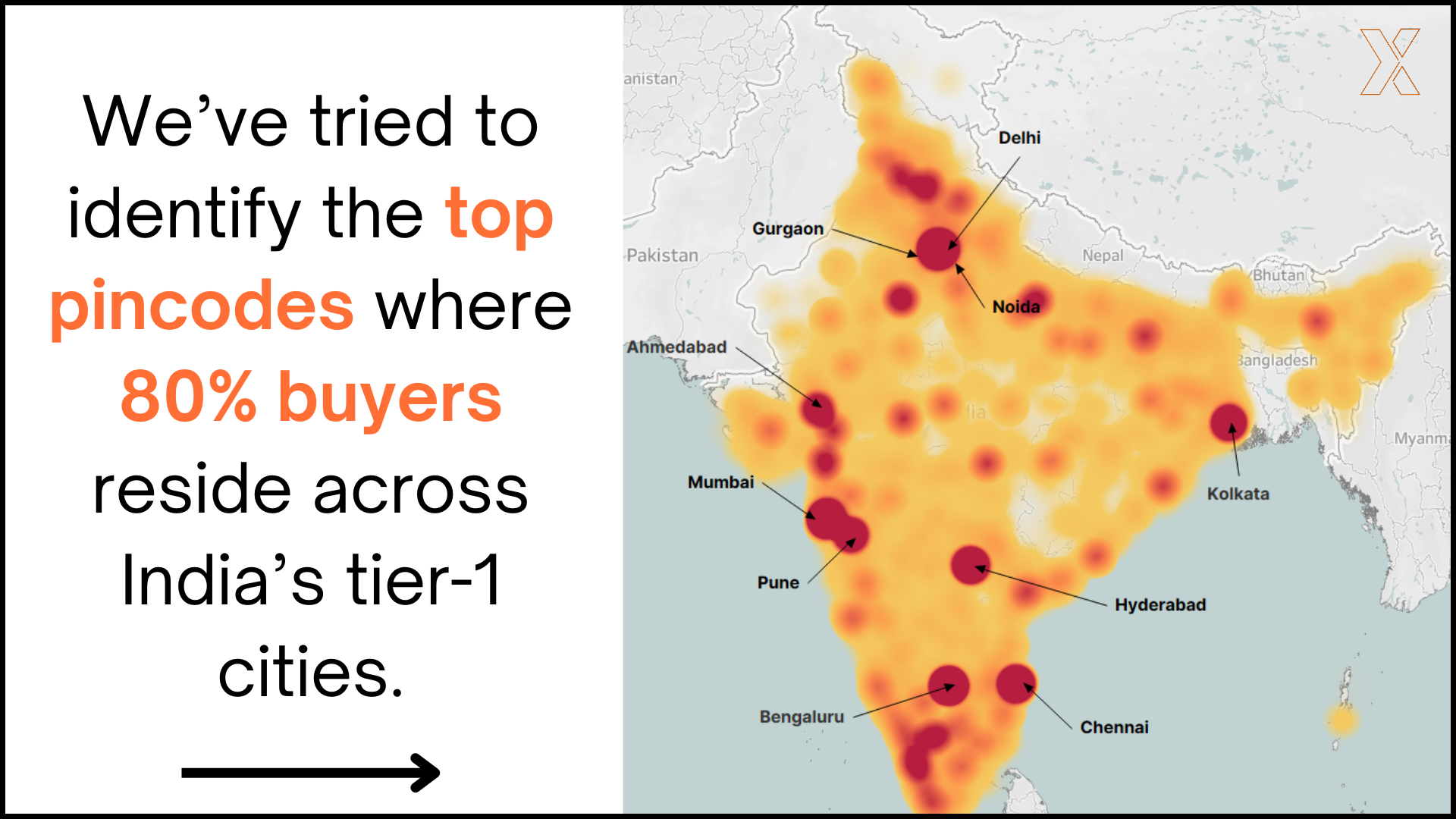

By analyzing real purchase data from over 12 million Indian buyers across 500+ brands, we uncovered a powerful insight that repeats across every major Indian metro:

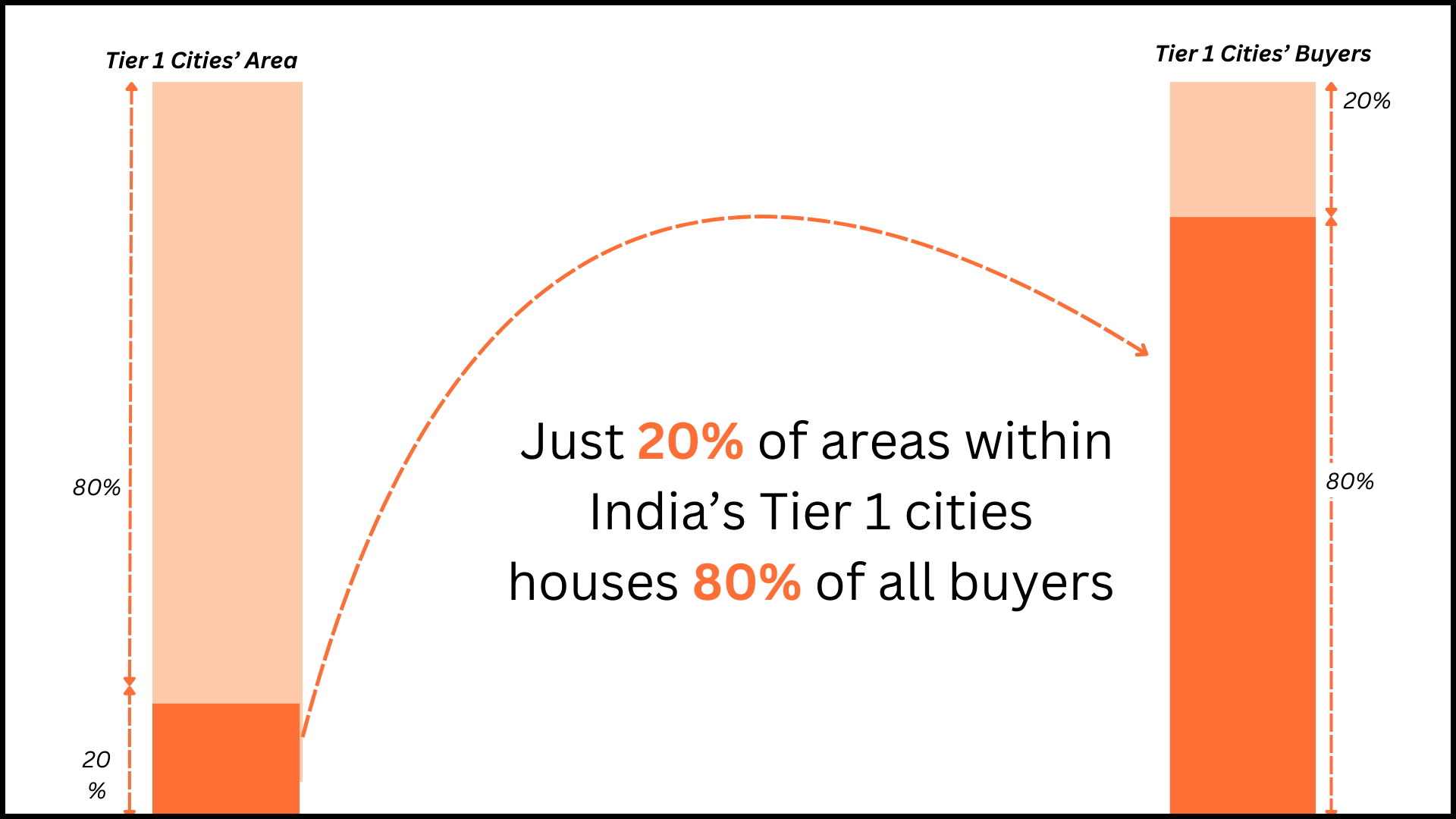

80% of all buyers in Tier-1 cities are concentrated in just 20% of their areas.

That’s not just a quirk. It’s a structural inefficiency in how most brands are spending.

The Problem With City-Level Targeting

When you treat an entire city as a homogeneous retail zone, three things happen:

- You waste impressions on people who don’t convert

- You fail to build frequency with those who actually do

- Your budgets spread thin, but your impact stays shallow

This is especially dangerous in India, where only 5% of consumers drive over 95% of discretionary purchases. Relying on population density as a proxy for demand leads to expensive, low-yield campaigns.

A Data-Driven Alternative: India’s Top Buying Pincodes 2024

To help brands cut through the noise, we created the India’s Top Buying Pincodes 2024 report—a city-wise breakdown of where actual buyers are concentrated.

This 30-slide report maps purchase behavior to pincodes across India’s Tier-1 cities. It’s designed to help brands:

- Pinpoint high-conversion neighborhoods for targeted marketing

- Optimize store locations, delivery zones, and offline activations

- Reduce ad wastage and improve ROAS across cities

What’s Inside the Report?

This isn’t a typical market report built on demographics. It’s based entirely on real retail and digital purchase data—tracking what buyers bought, where they live, and how densely they’re concentrated.

Each city section includes:

- The percentage of buyers captured in the top 20% of localities

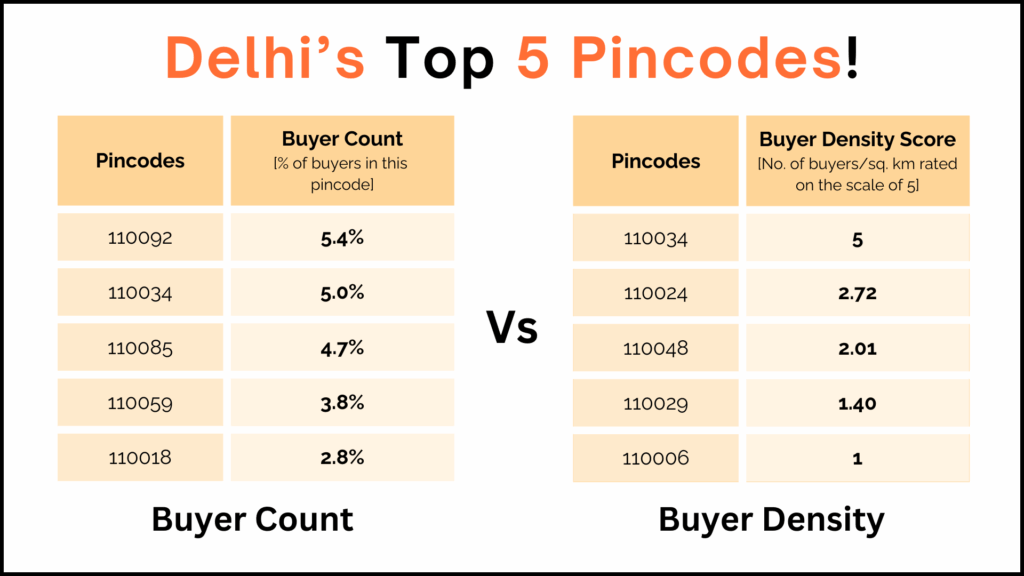

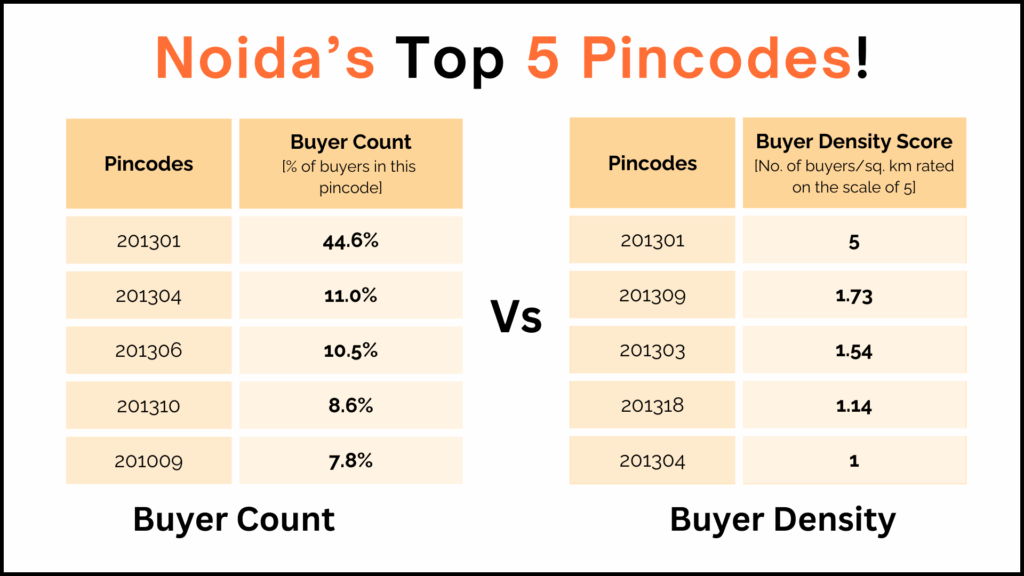

- A list of the top 5 pincodes by buyer count and buyer density

- A visual comparison of buyer count vs buyer density, so you can balance reach and frequency

A Glimpse Into India’s Buyer-Rich Zones

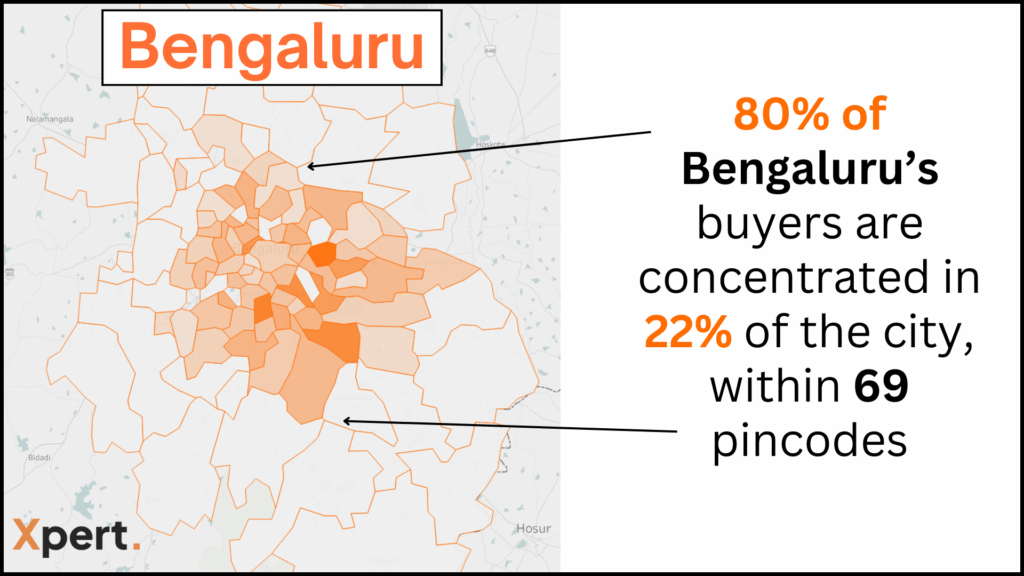

Bengaluru

22% of the city houses 80% of its buyers.

Pincodes like 560037, 560076, and 560038 dominate the city’s purchase activity.

Delhi

Just 26% of the city contains the bulk of buyer demand.

Top-performing pincodes include 110092, 110034, and 110085.

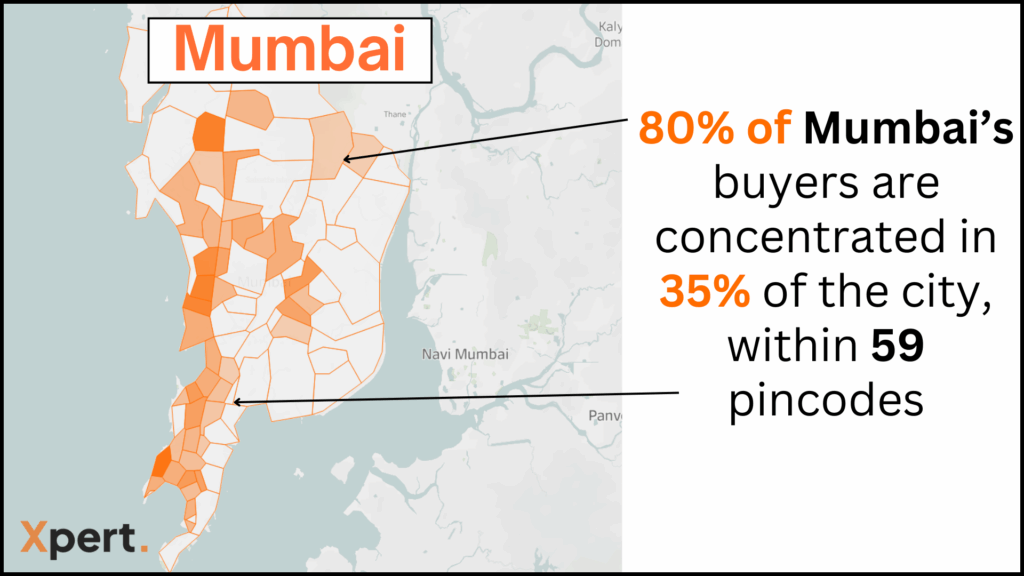

Mumbai

Despite being one of India’s most complex cities, just 35% of its geography covers 80% of buyers.

Pincodes like 400053, 400067, and 400101 consistently show strong purchase behavior.

Noida

Here’s the shocker: a single pincode—201301—accounts for nearly 45% of all buyer activity in the city.

Similar patterns emerge across Pune, Hyderabad, Gurgaon, Chennai, Ahmedabad, and Kolkata.

Why This Report Matters for Brand, Performance, and Retail Teams

This report is built for decision-makers across:

- Performance marketing, who need to boost ROAS with high-intent audiences

- Brand teams, who want to build awareness through frequency among actual buyers

- Retail heads, who plan store expansions, pop-ups, and in-store activations

By moving from broad “reach” metrics to buyer-led precision, brands can finally align efforts with impact. Fewer impressions, better targeting, and higher returns.

Stop Guessing. Start Targeting.

There’s no reason to keep guessing where your next buyers might come from.

This report shows you exactly where to focus—which neighborhoods to target, which pincodes to double down on, and which areas to avoid altogether.

If you’re spending big in Tier-1 cities, this is the roadmap you’ve been missing.

About Xpert

At Xpert, we help brands understand their customers through the only lens that matters—what they actually buy.

We track omni-channel purchase behavior across 12M+ Indians, giving brands the power to:

- Identify buyer-dense zones

- Target only those with proven purchase intent

- Improve marketing efficiency across every touchpoint

- Scale retail with clarity, not guesswork

Want to see it in action? Learn more at www.xpert.chat