Are you a brand looking to build your retail presence in Bangalore? But need to identify which localities & pincodes truly matter on the basis of buying demand?

While census data helps highlight regions that have the highest population density, given <5% of Indians account for > 95% of discretionary purchases – Population Density ≠ Buying Density.

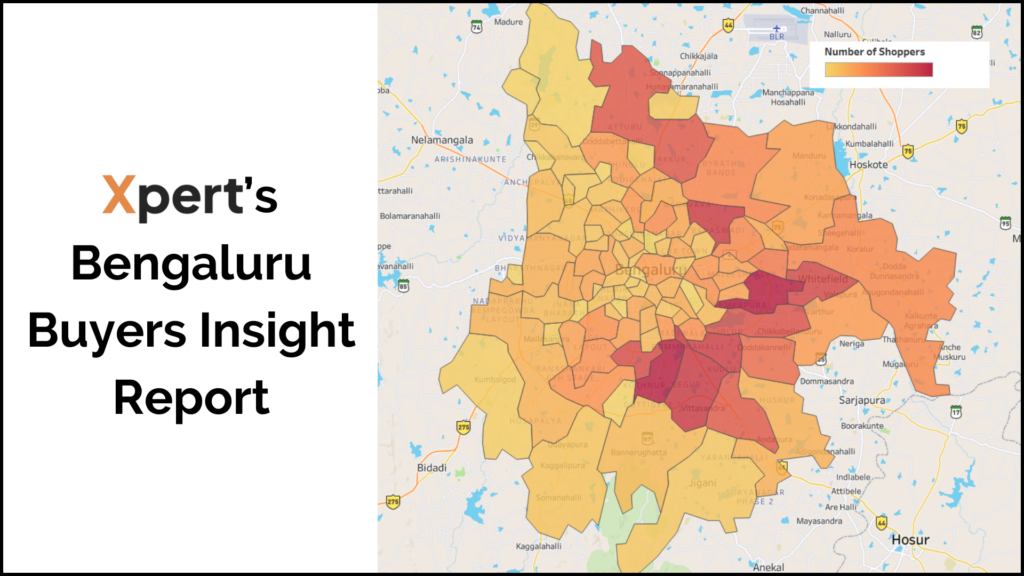

Which is why we recently published Xpert’s Bengaluru Buyers Insight Report — a data-driven approach that reveals where, what, and how Bangaloreans shop, helping brands make informed expansion decisions.

Our data source ?

At Xpert we’ve tracked over 300K Bangaloreans making retail & digital purchases across 500+ brands, to identify WHERE are they concentrated & WHAT are they buying!

The report aims to capture invaluable locational insights about Bengaluru’s shoppers—insights that go beyond just measuring footfalls inside your store. Stop relying on guesswork and start making decisions based on real consumer data!

In this report, you’ll uncover:

- Where should you expand next? — Identifying the most profitable markets and pincodes for new store openings.

- Which 20% of pincodes drive 80% of your sales? — Focusing on high-impact areas with concentrated buyer activity.

- Which malls attract the most buyers? — Discover the top retail hubs with strong foot traffic and conversion potential.

- Which locations have the highest revenue potential? — Align your expansion strategy with buyer concentration and spending power.

- What drives your target customers’ purchases? — Understand their buying preferences and affluence levels to optimize product assortment.

Bengaluru Buyers: The Surprising Insights

Among the many counter-intuitive findings, one stands out:

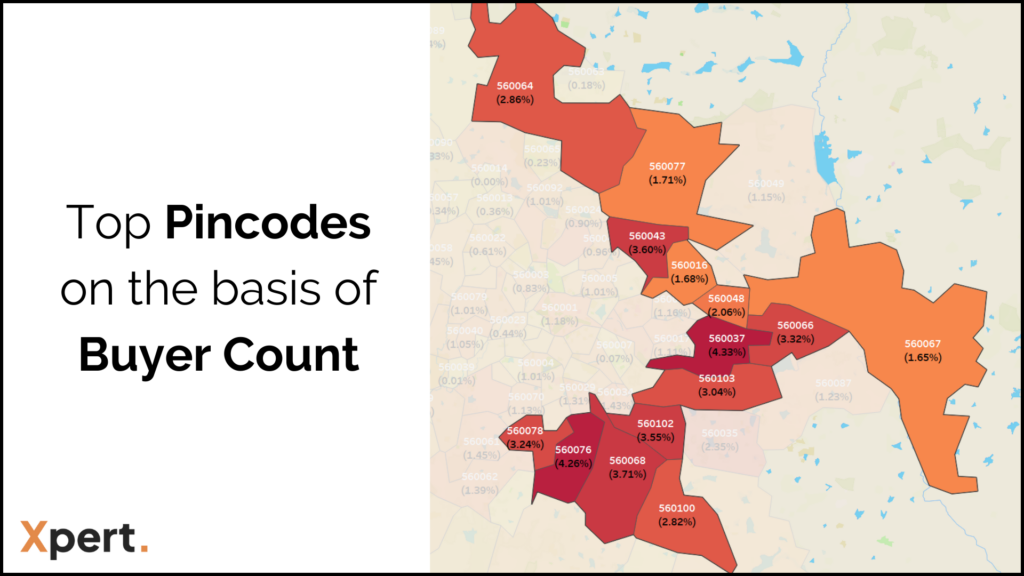

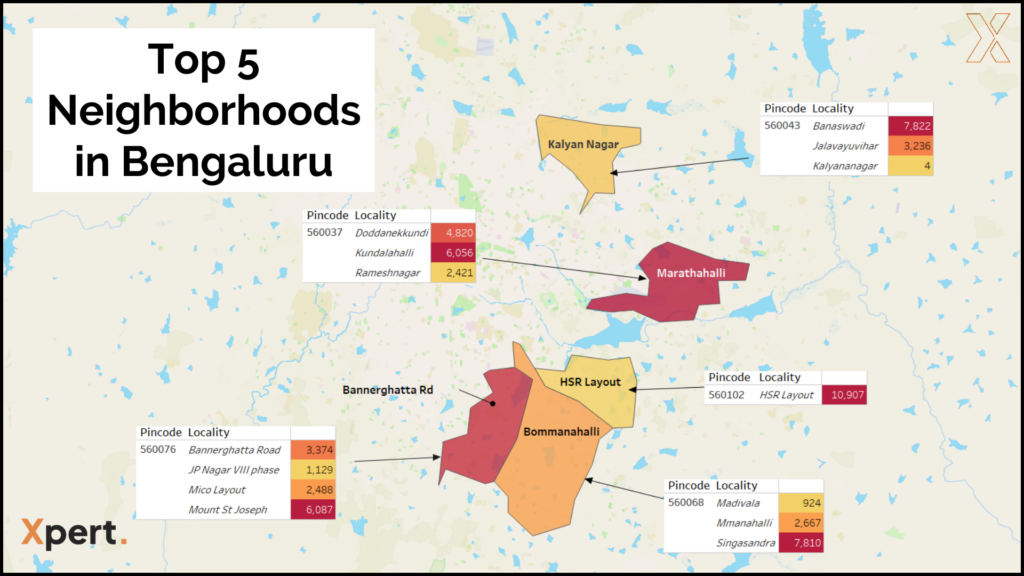

- Just 15 of Bengaluru’s 264 pincodes account for over 40% of buyers.

- Even more surprising? These buyers are further concentrated in just 5 neighborhoods.

Imagine knowing exactly which 5 neighborhoods will drive nearly half your sales. This hyper-local data is a goldmine for retail heads looking to razor-focus expansion strategy, optimize store placement, and avoid overspending on low-performing areas.

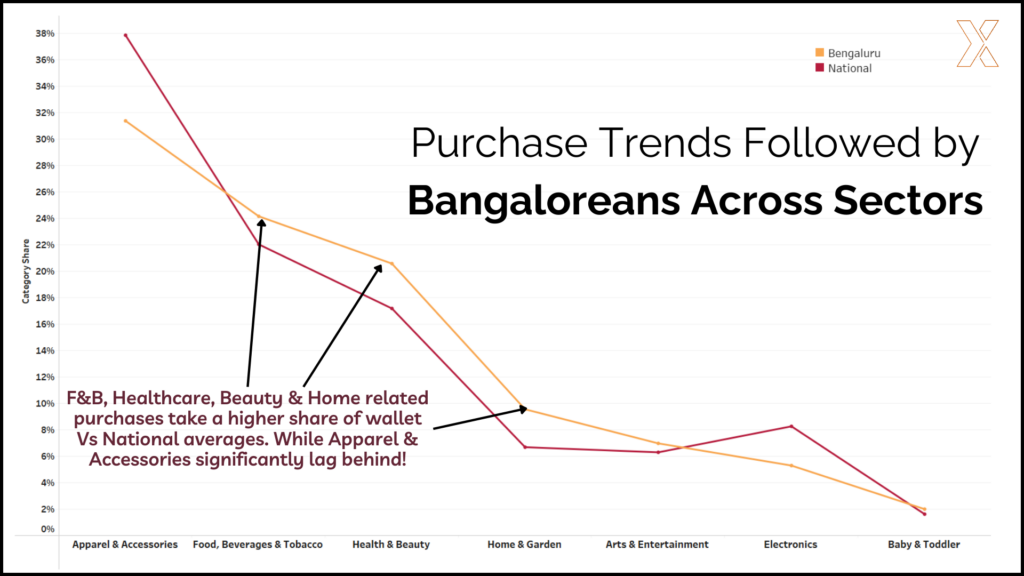

What Are Bangaloreans Buying?

Compared to national averages, Bengaluru buyers show unique preferences:

- Higher Share of Wallet: F&B, Healthcare, Beauty, and Home categories dominate.

- Lower Interest: Demand for Apparel & Accessories significantly lags behind the national average.

Knowing what Bangaloreans love—and what they don’t—lets you fine-tune your inventory and optimize store layouts to match local demand. Stop guessing, start stocking what sells.

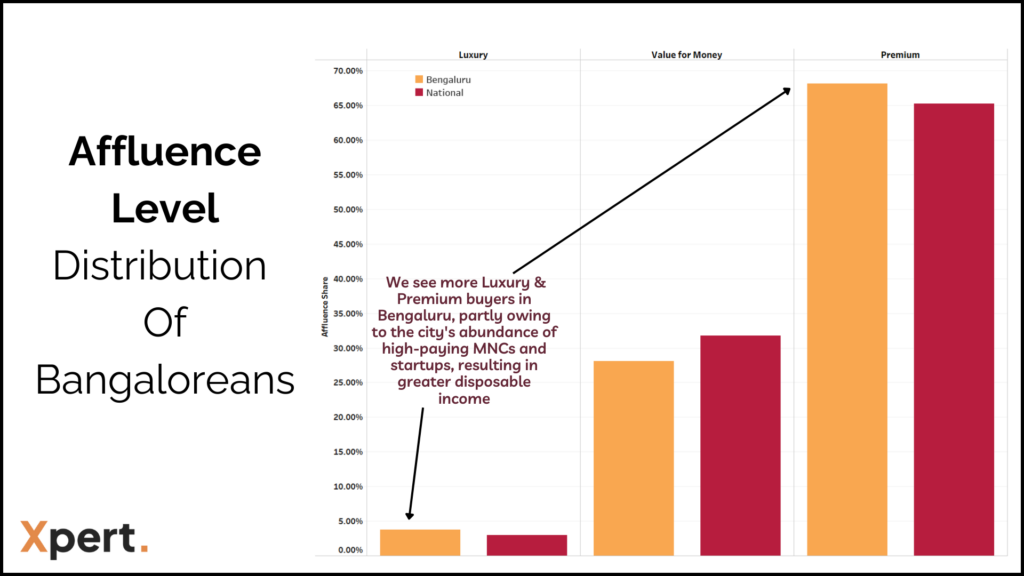

How much are Bangaloreans willing to spend?

Bengaluru boasts a higher concentration of Luxury & Premium buyers. The city’s large population of high-earning professionals from MNCs and startups means greater disposable income and a willingness to spend on premium products. If you’re a luxury retailer, this is your cue to double down on high-end offerings. For budget-focused brands, it’s an opportunity to position premium lines strategically without alienating your core base.

Where Exactly Are Bengaluru’s Active Shoppers Located?

Here’s a sneak peek into the Top 5 Key Neighborhoods driving sales:

- HSR Layout

- Kalyan Nagar

- Bommanahalli

- Marathahalli

- Bannerghatta Road

Knowing exactly where your buyers live can help you plan new stores, optimize delivery logistics, plan hyper-local promotions, and even identify the perfect spot for your next store.

Where Shoppers Actually Show Up?

Bangaloreans love their malls. Because where else can you get air conditioning, no traffic, a solid food court lineup, and an excuse to browse things you don’t need? But not all malls are equal when it comes to conversions. If you’re setting up pop-ups, in-store activations, or retail promos, these are the places that matter.

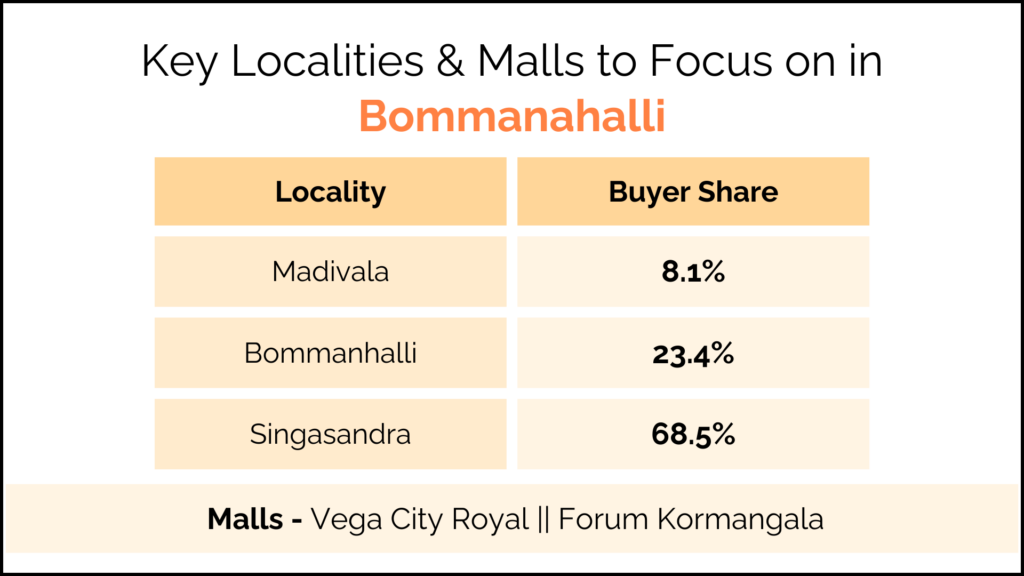

For example, Bommanahalli (Pincode 560068) boasts 7,810 buyers. This area is home to prominent malls like Vega City Mall and Forum Koramangala Mall. Understanding the buyer distribution in this locality can help you focus your retail efforts more effectively:

- Madivala: 8.1%

- Bommanahalli: 23.4%

- Singasandra: 68.5%

With such insights, you can pinpoint where your potential customers are most active and tailor your strategies accordingly.

Ready to transform your retail strategy? Download the Xpert Bengaluru Buyers Insight Report here and tap into Bengaluru’s most lucrative retail opportunities for your next big expansion.

About Xpert

At Xpert we track omni-channel purchases across 12M+ Indians to help brands better target their marketing & scale their distribution.

Leveraging our data brands are able to optimize their marketing spends, strategically scale their retail expansion & identify demand blindspots.

Here’s more about us : www.xpert.chat