Expanding your retail footprint in Chennai? But unsure which localities and pincodes actually drive sales?

Most brands assume high foot traffic means more buyers—but that’s not always true. Less than 5% of Indians account for over 95% of discretionary purchases, meaning Population Density ≠ Buying Density.

That’s why we created Xpert’s Chennai Buyers Insight Report 2024—a data-backed roadmap to understanding where, what, and how Chennaiites shop, so brands can make profitable expansion decisions.

Our Data Source?

At Xpert, we’ve tracked over 157K+ Chennai buyers making retail and digital purchases across 450+ brands, uncovering WHERE they are concentrated and WHAT they are buying!

In the Xpert Chennai Buyers Insight Report, you’ll uncover:

- The top 14 pincodes driving 40% of all retail purchases

- The surprising rise of Health & Beauty as Chennai’s leading purchase category

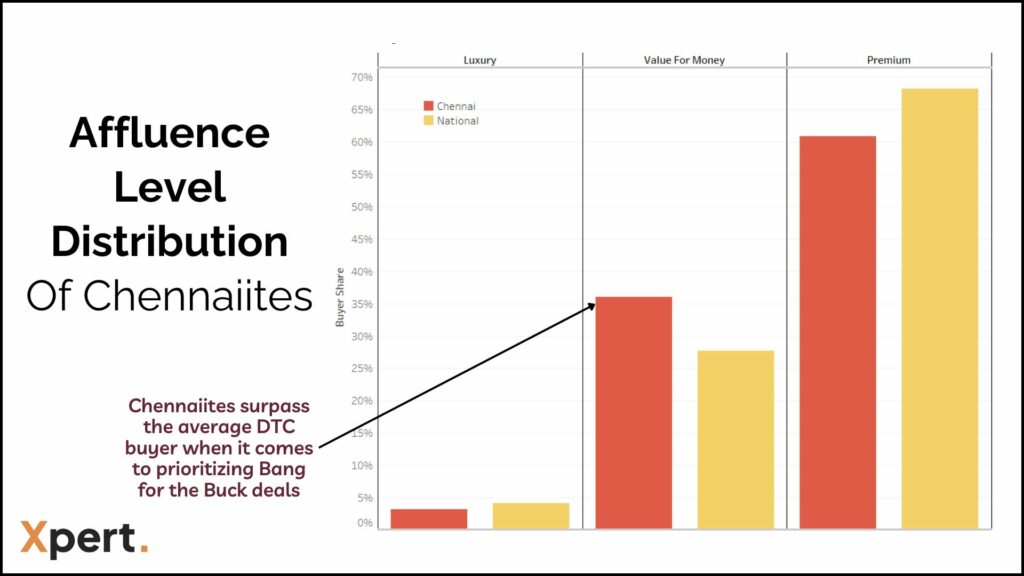

- Why price sensitivity is shaping Chennai’s DTC landscape

- Actionable insights for brands to maximize hyperlocal impact

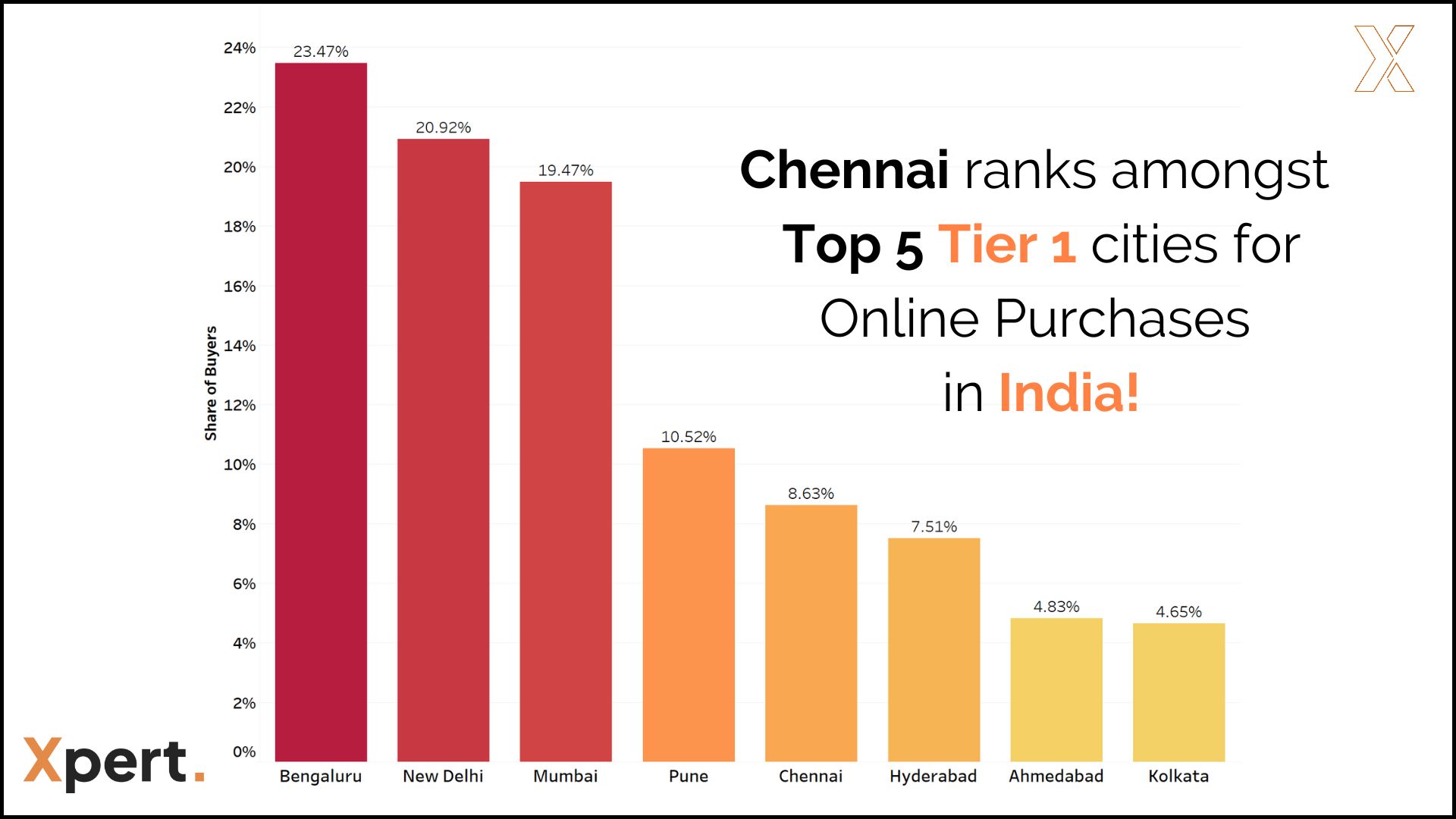

Chennai: A Powerhouse for Online DTC Purchases

Ranked among the top five Tier 1 cities for online DTC sales, Chennaiites are proving to be strategic shoppers who prioritize value-for-money deals while maintaining impressive brand loyalty. The city’s repeat purchase rate of 23% is second only to another major metro, indicating that once a brand wins over a Chennai shopper, they tend to stick around.

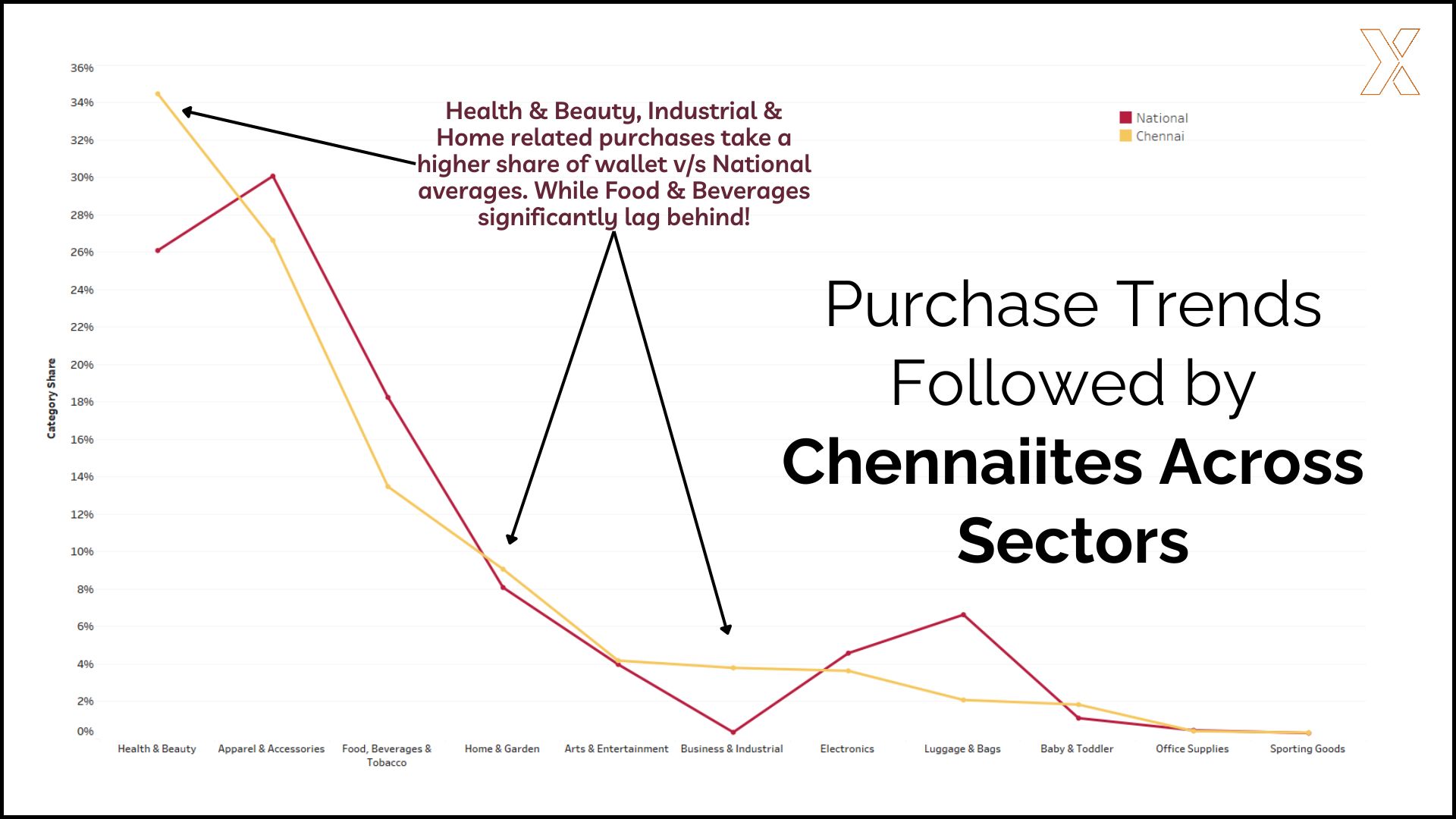

What’s Hot in Chennai?

The purchasing landscape in Chennai presents a fascinating mix of trends:

- Health & Beauty and Industrial & Home-related purchases dominate the spending, exceeding national averages.

- Surprisingly, Food & Beverages lag behind, suggesting opportunities for brands in this sector to rethink their strategies.

- Chennai buyers exhibit high price sensitivity, favoring discounts and bundled deals.

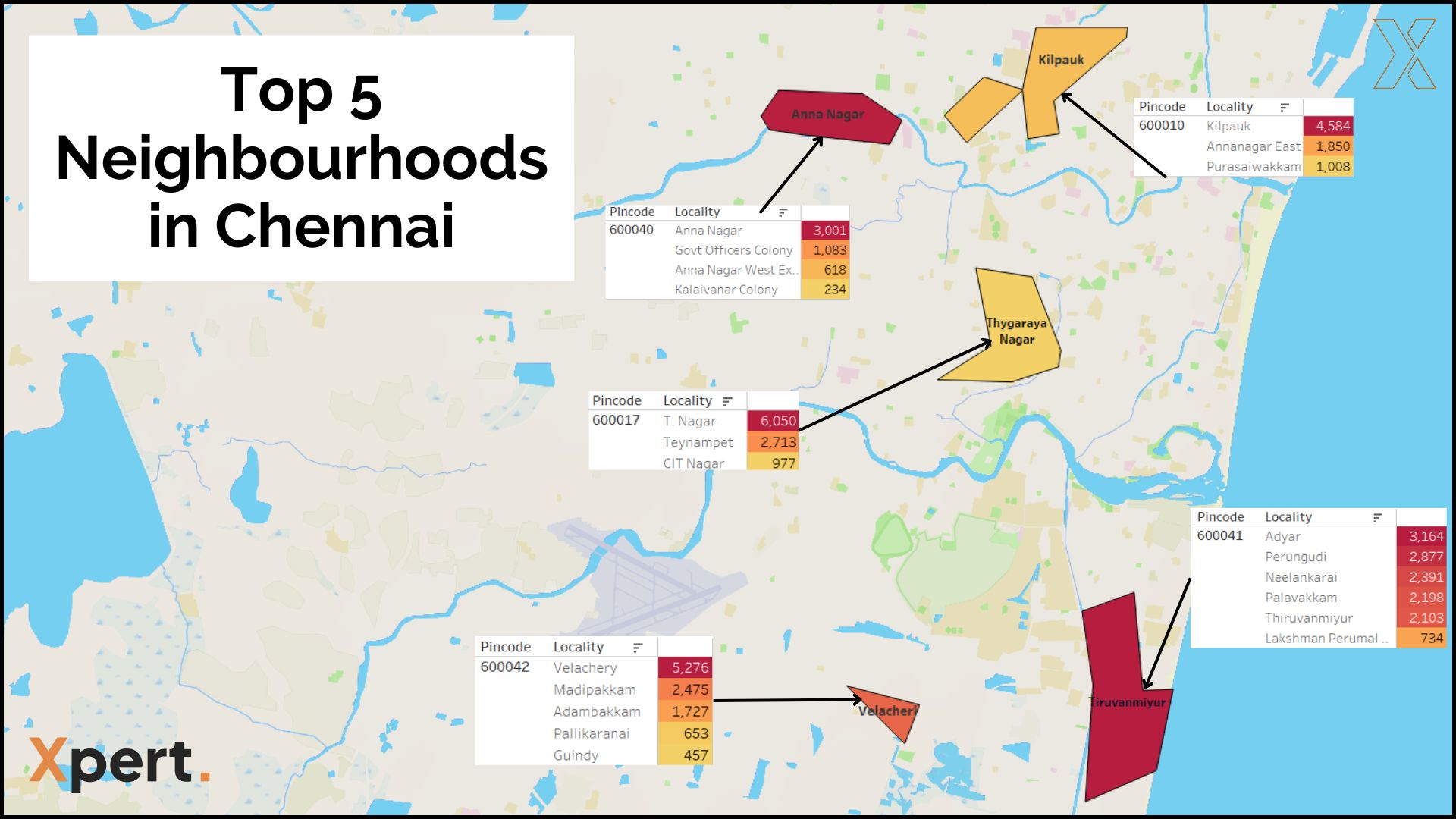

Where Are Chennai’s Biggest Buyers?

If your retail strategy isn’t hyperlocal yet, it’s time to rethink. Chennai’s spending power is concentrated in just 14 key pincodes, accounting for over 40% of total buyers. Understanding these prime neighborhoods can be a game-changer for brands looking to optimize store locations, hyperlocal marketing, and inventory planning. Here’s a breakdown of top retail zones:

Adyar & ECR Belt: High-Spending Residential Hub

- Top Localities: Adyar (23.49%), Perungudi (21.36%), Neelankarai (17.75%), Palavakkam (16.32%), Thiruvanmiyur (15.62%)

- Popular Category: Health & Beauty

- Opportunity: Premium personal care brands, organic wellness products, and boutique experiences thrive here.

Anna Nagar: Chennai’s Shopper’s Paradise

- Top Localities: Anna Nagar (60.8%), Govt. Officers Colony (21.94%), Anna Nagar West Ext. (12.52%)

- Popular Category: Health & Beauty

- Opportunity: High footfall and a demand for premium skincare, cosmetics, and wellness offerings make it an ideal market for DTC brands.

Velacheri: The Mall Capital of Chennai

- Top Localities: Velacheri (49.83%), Madipakkam (23.38%), Adambakkam (16.31%)

- Popular Category: Health & Beauty

- Opportunity: This growing IT and residential hub is a stronghold for brands targeting young professionals and families.

Kilpauk & Purasaiwakkam: Apparel & Accessories Hub

- Top Localities: Kilpauk (61.6%), Annanagar East (25.86%), Purasaiwakkam (13.54%)

- Popular Category: Apparel & Accessories

- Opportunity: Ideal for fashion retailers, with a mix of traditional and modern apparel preferences.

T. Nagar & Thyagaraya Nagar: The Beating Heart of Chennai’s Retail

- Top Localities: T. Nagar (62.11%), Teynampet (27.85%), CIT Nagar (10.03%)

- Popular Category: Health & Beauty

- Opportunity: One of Chennai’s most competitive retail landscapes, perfect for brands with strong in-store experiences and promotional strategies.

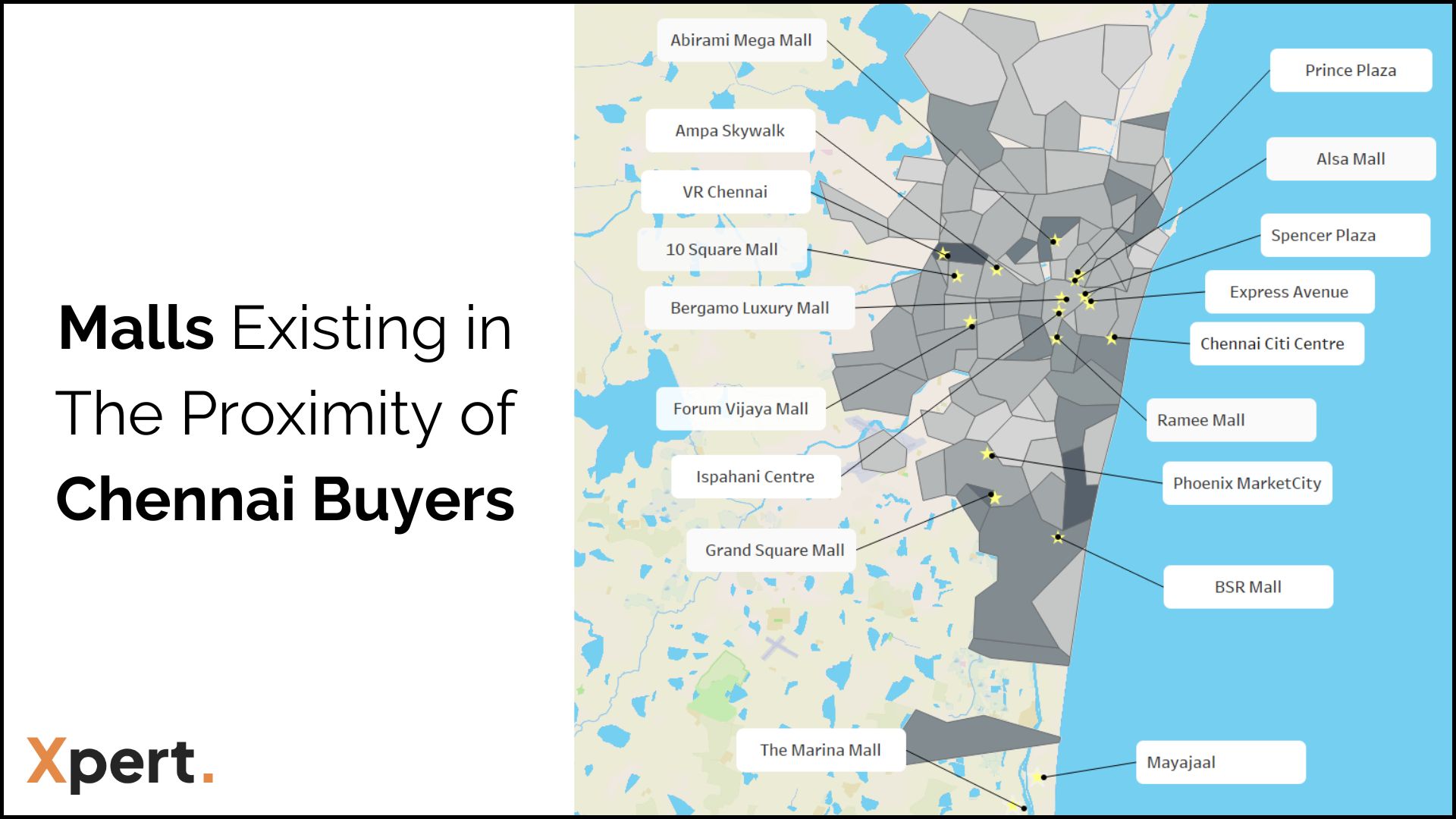

Where Shoppers Actually Show Up

Beyond popular neighborhoods, let’s look at where Chennaiites actually shop. Major malls attract consistent footfall, making them prime retail destinations:

- Phoenix MarketCity (Velacheri) – Premium brands, high weekend traffic.

- Express Avenue (Royapettah) – Mix of luxury, mid-tier, and casual brands.

- VR Chennai (Anna Nagar) – Popular for retail and entertainment.

- Ampa Skywalk (Aminjikarai) – Mid-tier brands and accessories.

- Chennai Citi Centre (Mylapore) – Mix of traditional and modern shoppers.

For maximum impact, brands should focus on both high-spending localities and key malls to reach Chennai’s most active shoppers.

How This Report Solves Your Retail Challenges

Understanding Chennai’s market is not just about knowing where people shop, but also why and how they make their purchasing decisions. This report helps brands:

- Identify high-value locations for offline stores and hyperlocal ads

- Optimize inventory based on real consumer demand

- Personalize marketing campaigns that speak to Chennai’s price-sensitive shoppers

- Plan data-driven expansion strategies for new retail and DTC growth

In short, this report is like a good Chennai filter coffee—strong, insightful, and just what you need to wake up your retail strategy!

Key Takeaways for Brands

Hyperlocal insights like these are no longer a luxury—they’re a necessity for retail and e-commerce brands. Whether you’re a national chain, a DTC brand, or a local retailer, understanding who is buying, what they are buying, and where they are buying it can help you make data-driven decisions that maximize sales and customer retention.

And as they say in Chennai, “If you don’t know where your customers are, you’re like a dosa without chutney—something’s definitely missing!”

Download the Full Report

If you’re a marketing head looking to refine your Chennai retail strategy, download the full Xpert Chennai Buyers Insight Report 2024 for deeper analytics, customer segmentation, and actionable strategies tailored for Chennai’s dynamic market.

About Xpert

At Xpert we track omni-channel purchases across 12M+ Indians to help brands better target their marketing & scale their distribution.

Leveraging our data brands are able to optimize their marketing spends, strategically scale their retail expansion & identify demand blindspots.

Here’s more about us : www.xpert.chat