Looking to grow your jewellery brand’s footprint across India? But not sure which cities, pincodes, or store locations actually drive purchases?

Many brands rely on general population data or competitor presence to guide expansion. But the reality is, less than 5% of Indians account for over 95% of discretionary jewellery purchases—meaning Population Density ≠ Buying Density.

Which is why we created the Xpert Jewellery Buyers Insight Report 2024—a data-driven breakdown of where, what, and how Indians are purchasing jewellery. Based on over 500,000 actual buyers and 19,000 pincodes, this report gives brands a clear roadmap to unlock high-conversion growth zones.

How We Built This Report

At Xpert, we analyzed purchase behavior from over 500+ omnichannel brands, tracking both offline POS and digital transactions. We stitched together shopping journeys from millions of consumers to uncover:

- Which pincodes have the highest buyer density and concentration

- What type of jewellery is being bought—and where

- Which cities and localities are truly jewellery-first zones

- What other categories jewellery buyers also shop from

Our goal was simple: to help jewellery brands stop relying on assumptions and start making location-intelligent retail decisions.

What’s Inside the Xpert Jewellery Buyers Insight Report

This report is your blueprint to identify India’s most lucrative markets for jewellery. Inside, you’ll find:

- The top-performing cities and districts for jewellery sales

- A deep dive into pincode-level buyer concentration

- A breakdown of jewellery preferences by city tier

- Consumer insights based on identity traits and purchase goals

- The top retail hotspots in Tier 1 metros like Delhi NCR, Mumbai, Bengaluru, Hyderabad, and more

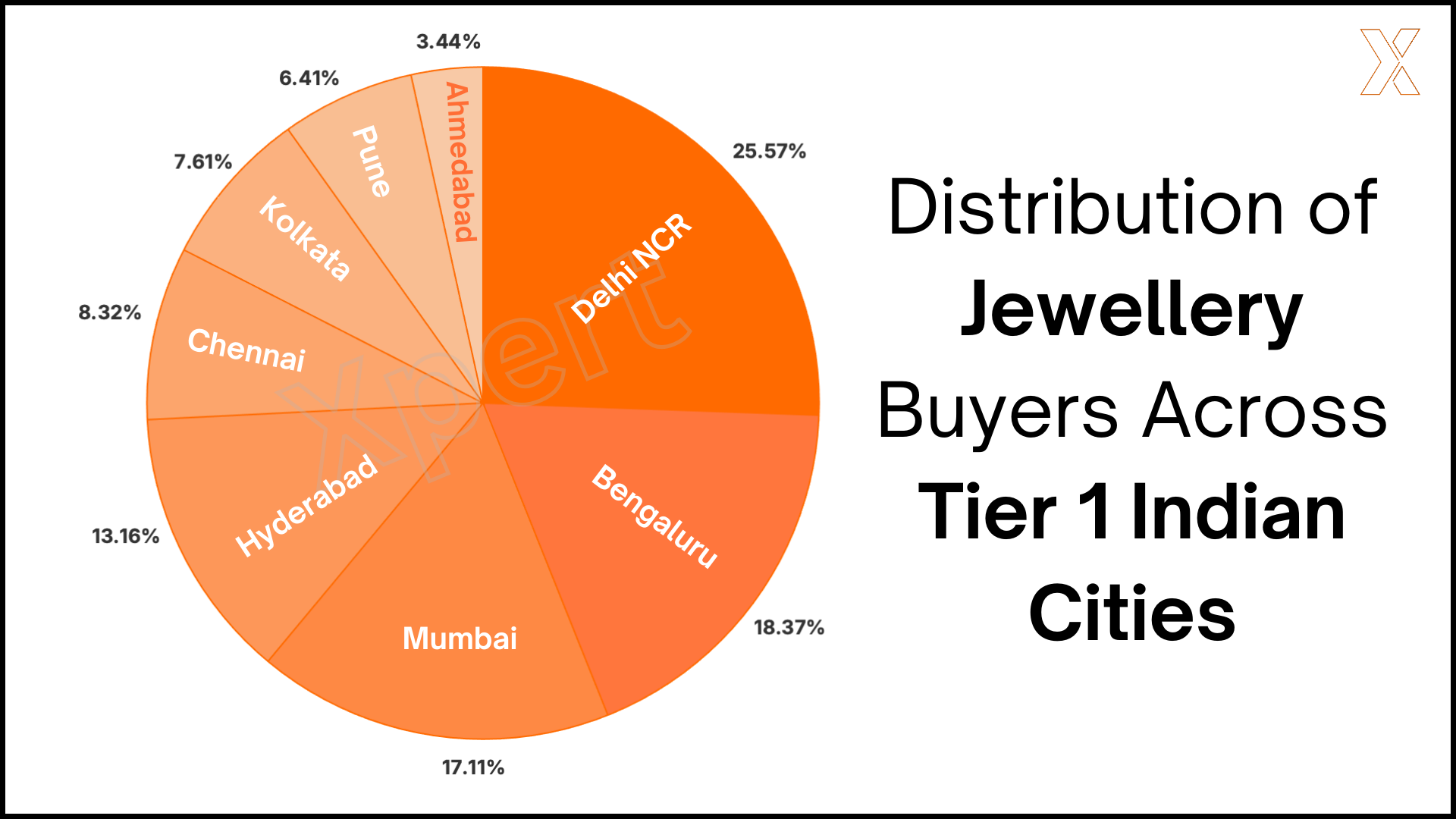

Jewellery Demand Is Highly Concentrated

Across Tier 1 cities, jewellery buyers aren’t evenly spread—they’re heavily concentrated in high-intent clusters.

Our research reveals that 80% of jewellery buyers come from just 22% of Tier 1 city areas. That means your brand might be spending across the city, while your real buyers are packed into a handful of neighbourhoods.

Let’s look at a few examples from the report:

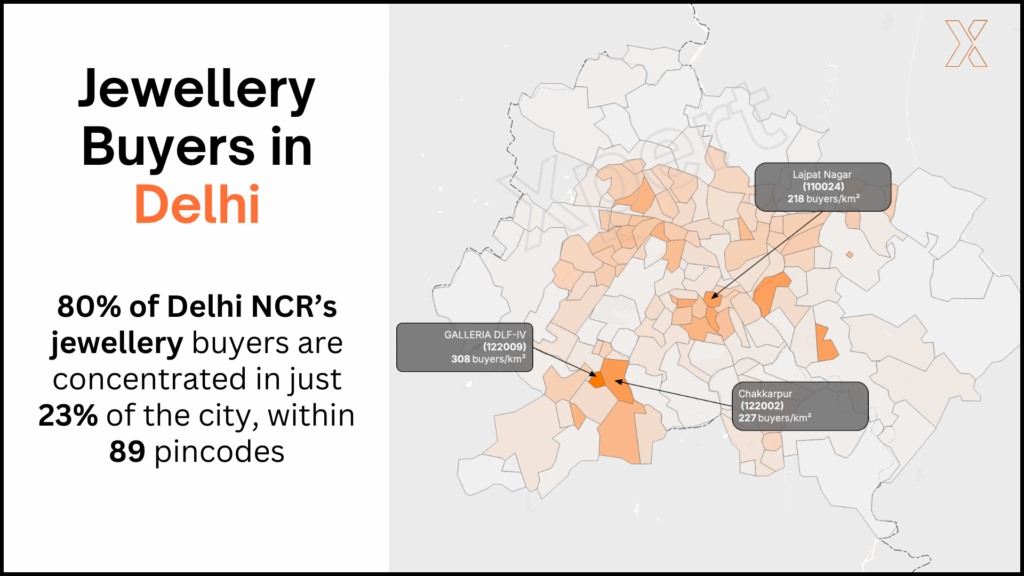

Delhi NCR: Jewellery Capital With High Pincode Variation

In Delhi NCR, 80% of jewellery buyers are concentrated in just 23% of the city, spread across 89 key pincodes.

Top Pincodes by Buyer Count:

- 201301 (Noida) – 5.82%

- 122001 (Gurgaon) – 4.51%

- 122002 – 3.27%

Top Pincodes by Buyer Density: - 122209 – Score 5

- 122002 – Score 2.13

Mumbai: India’s Jewellery Stronghold

80% of Mumbai’s jewellery buyers are concentrated in just 18% of the city, across 87 pincodes.

Top Pincodes by Buyer Count:

- 400053 (Andheri West) – 3.7%

- 400067 – 2.32%

- 401107 – 2.31%

Top Pincodes by Buyer Density: - 400064 – Score 5

- 400054 – Score 4.83

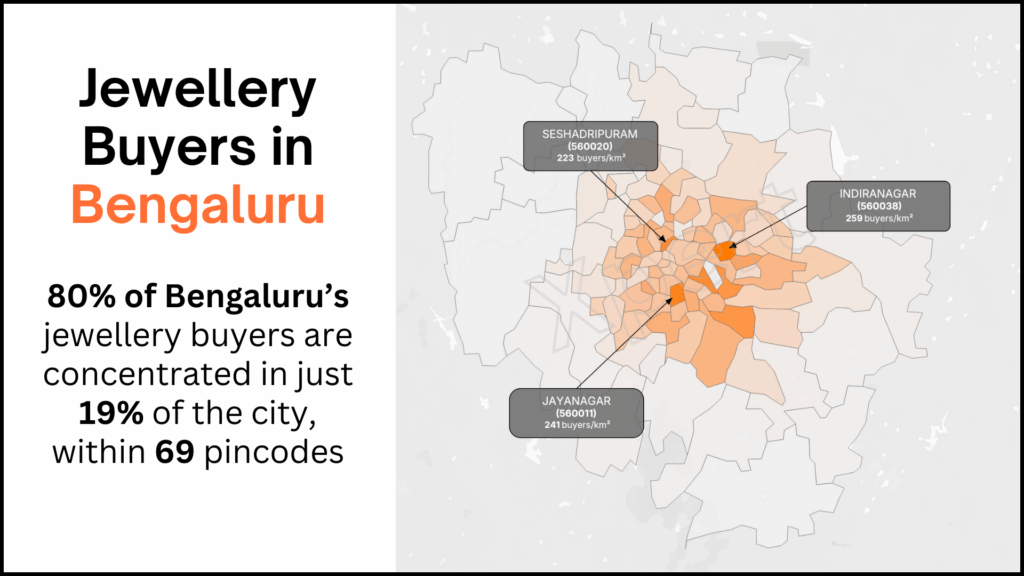

Bengaluru: Fast-Growing Jewellery Hub

In Bengaluru, just 19% of the city accounts for the majority of jewellery purchases.

Top Pincodes by Buyer Count:

- 560037 (Marathahalli) – 4.23%

- 560076 – 3.9%

- 560068 – 3.81%

Top Pincodes by Buyer Density: - 560038 (Indiranagar) – Score 5

- 560011 – Score 3.74

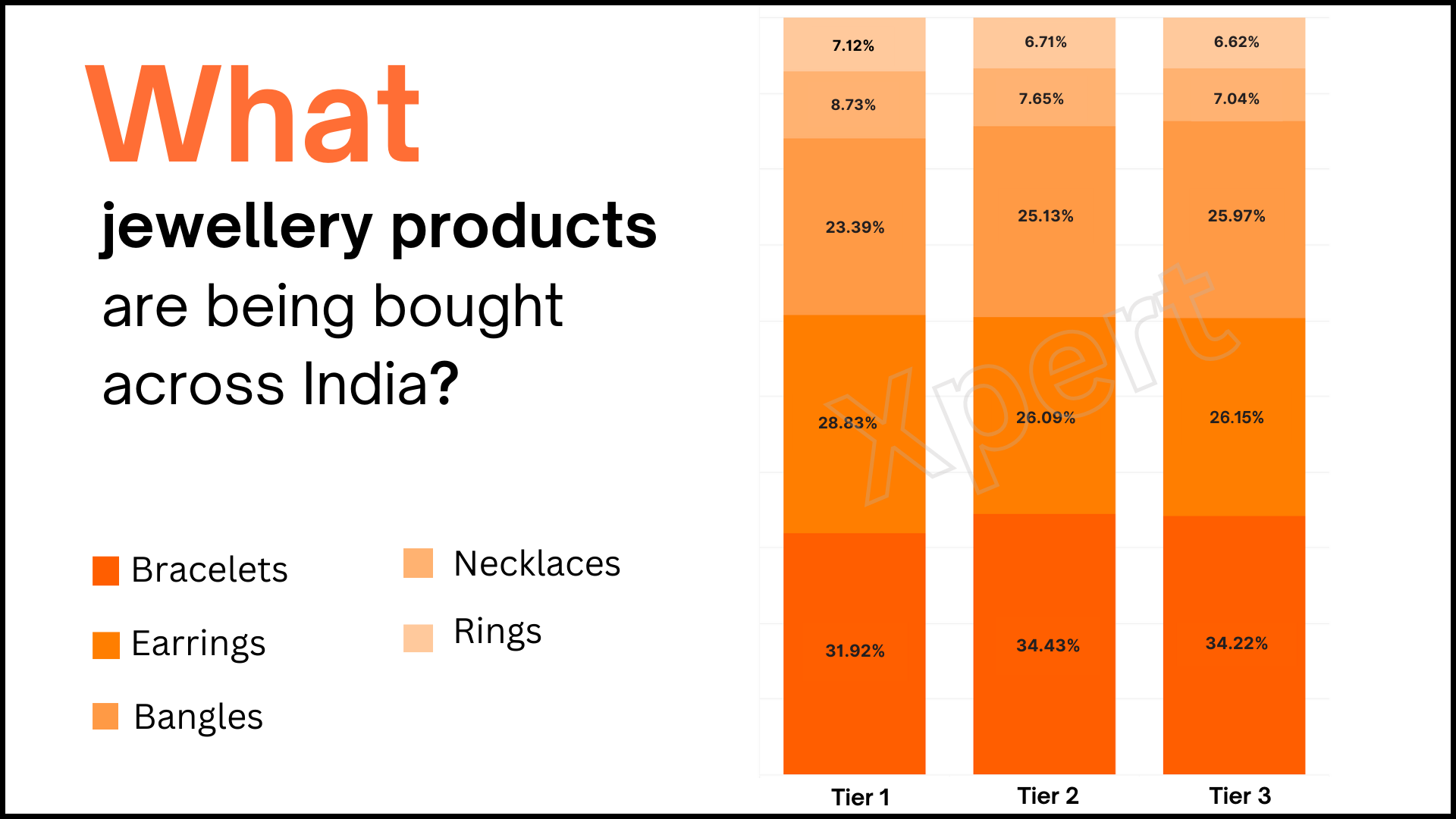

What Are Jewellery Buyers Purchasing?

The report also highlights city-tier based preferences.

Tier 1 cities show a greater skew toward earrings, bangles, and necklaces, while Tier 2 and Tier 3 cities show higher share for rings and bracelets.

Breakdown of category preferences (across all tiers):

- Earrings – 35.82%

- Necklaces – 31.78%

- Bangles – 21.12%

- Rings – 11.28%

- Bracelets – 6.71%

What Else Are Jewellery Buyers Shopping For?

Jewellery buyers aren’t just jewellery-first—they tend to have strong overlaps with other discretionary and lifestyle categories.

Here’s what they’re most likely to purchase:

- Personal Care – 19.74%

- Clothing – 16.83%

- Health Care – 18.57%

- Handbags & Wallets – 14.71%

These overlaps give brands clues into how to position, merchandise, and market their offerings for maximum resonance.

How This Report Helps Jewellery Brands Expand Smarter

This report is more than a data dump—it’s a retail strategy tool. Whether you’re launching a new store, planning a franchise expansion, or scaling your digital-to-retail push, the insights inside help you:

- Identify high-buyer-density locations for EBO or MBO rollout

- Optimize store placement to minimize spend and maximize conversions

- Improve ROAS by using verified buyer-based targeting instead of interest-based

- Reduce media wastage by eliminating low-intent geographies from your plans

- Personalize campaigns based on regional product preferences

Ready to Map Your Next Jewellery Store to Real Buyers?

If your brand is serious about jewellery, it’s time to stop guessing and start targeting where India actually buys.

Get the Xpert Jewellery Buyers Insight Report 2024 and find out where your next 10,000 customers already live.

About Xpert

At Xpert, we track omni-channel purchases from over 12 million Indians to help brands understand where demand lives—and how to act on it.

Our tools help brands:

- Identify buyer-dense zones

- Improve performance marketing

- Scale retail footprints with confidence

- Minimize media and distribution wastage

Want to unlock retail growth using real purchase behavior?

Learn more at www.xpert.chat