Looking to grow your home-focused brand across India? But unsure which cities, localities, and stores truly influence buying behavior among homemakers?

For most brands targeting home & lifestyle, FMCG, or décor categories, homemakers are the core decision-makers. But here’s the catch—not all homemakers are alike, and not all locations deliver equal returns. Traditional data based on household count or population density falls short because it doesn’t reflect real buying behavior.

Which is why we created the Xpert Homemakers Insight Report 2025—a data-backed deep dive into the psychology, preferences, and location trends of India’s most active homemaker buyers.

How We Built This Report

At Xpert, we studied over 3 million verified homemakers through their retail and digital purchases across 500+ brands and 19,000+ pincodes.

We went beyond just footfall or visit data to map actual transaction behavior—what homemakers are buying, where they live, and what drives their choices.

We then stitched this together to uncover:

- Which products and categories homemakers engage with most

- Where premium homemakers are concentrated, down to the pincode

- What motivates their purchases, and how preferences vary by city tier

- Which identity traits influence their shopping patterns

This report isn’t about assumptions—it’s about actual buying signals from one of India’s most influential consumer segments.

Inside the Xpert Homemakers Report

This report captures insights that help brands align with real homemaker behavior. You’ll learn:

- Which cities and neighborhoods house the most valuable homemakers

- Pincode-level hotspots for home, food, and personal care purchases

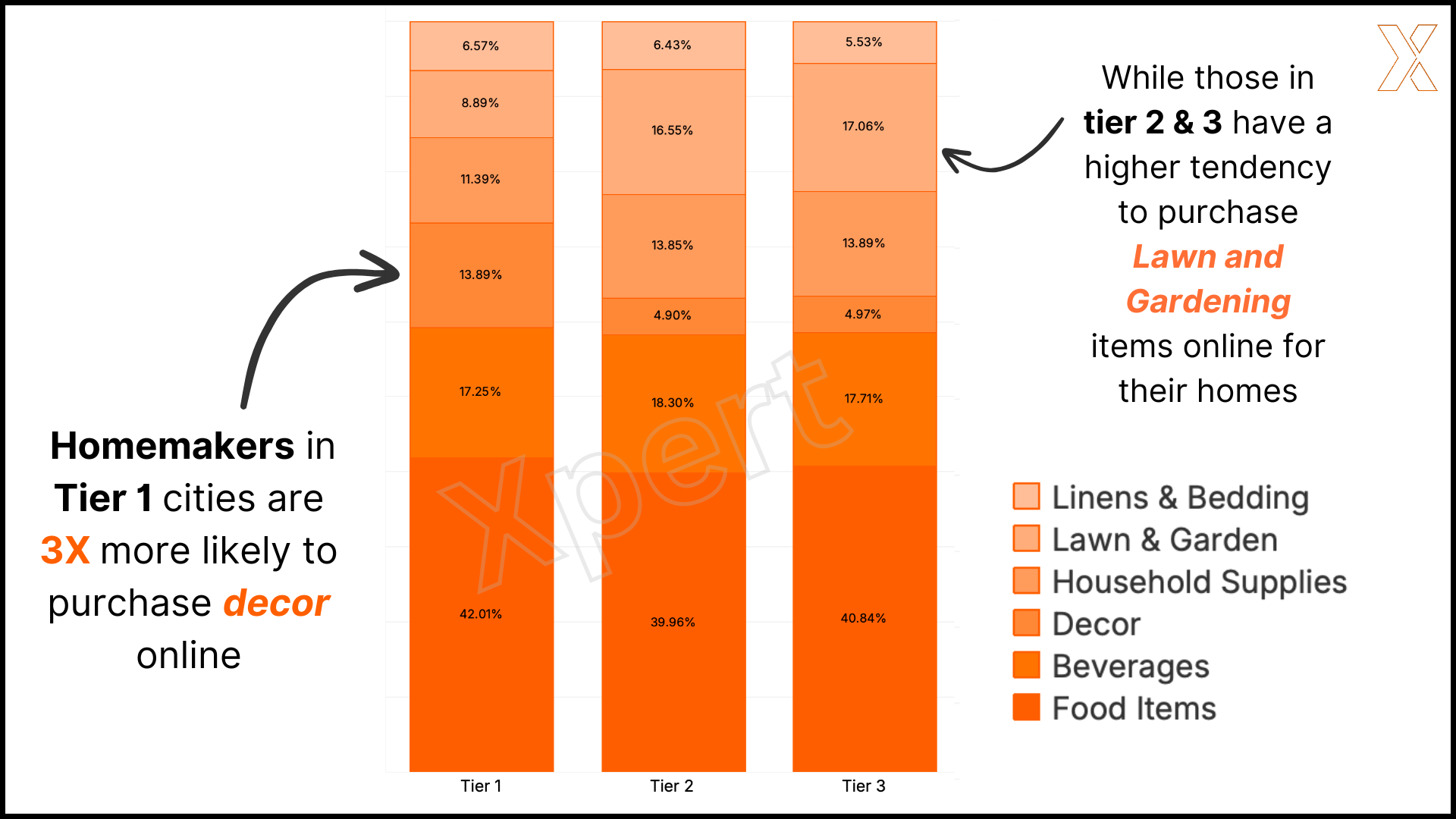

- How homemakers in Tier 1 cities differ from those in Tier 2/3

- The top identity traits and motivations that drive buying decisions

- Where to expand stores, place GT/MT partnerships, and run hyperlocal campaigns

Homemakers Buy with Purpose—And Precision

Today’s homemakers aren’t passive buyers—they are conscious, connected, and category-savvy. Our research shows they tend to cluster their buying activity across three core areas:

- Home & Garden (31.48%)

- Food & Beverages (29.72%)

- Health & Beauty (19.36%)

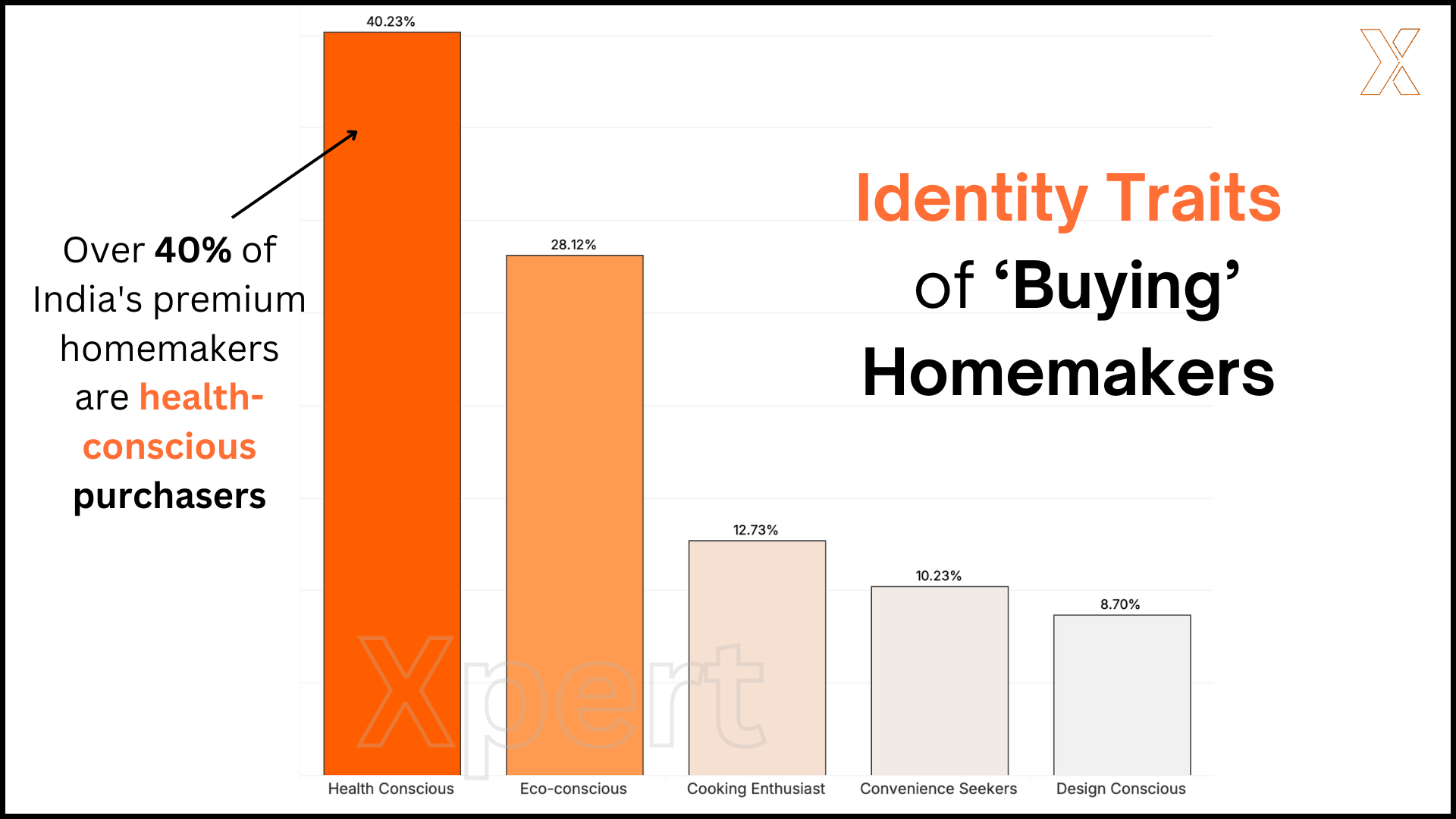

They are also more likely to be health-conscious, design-oriented, and goal-driven in their purchases.

What does this mean for brands? That their buyer mindset is shaped by identity and lifestyle goals, not just utility. Whether it’s choosing chemical-free cleaning supplies or curating their home aesthetics, today’s homemakers shop with intention.

Where Are These Buyers Concentrated?

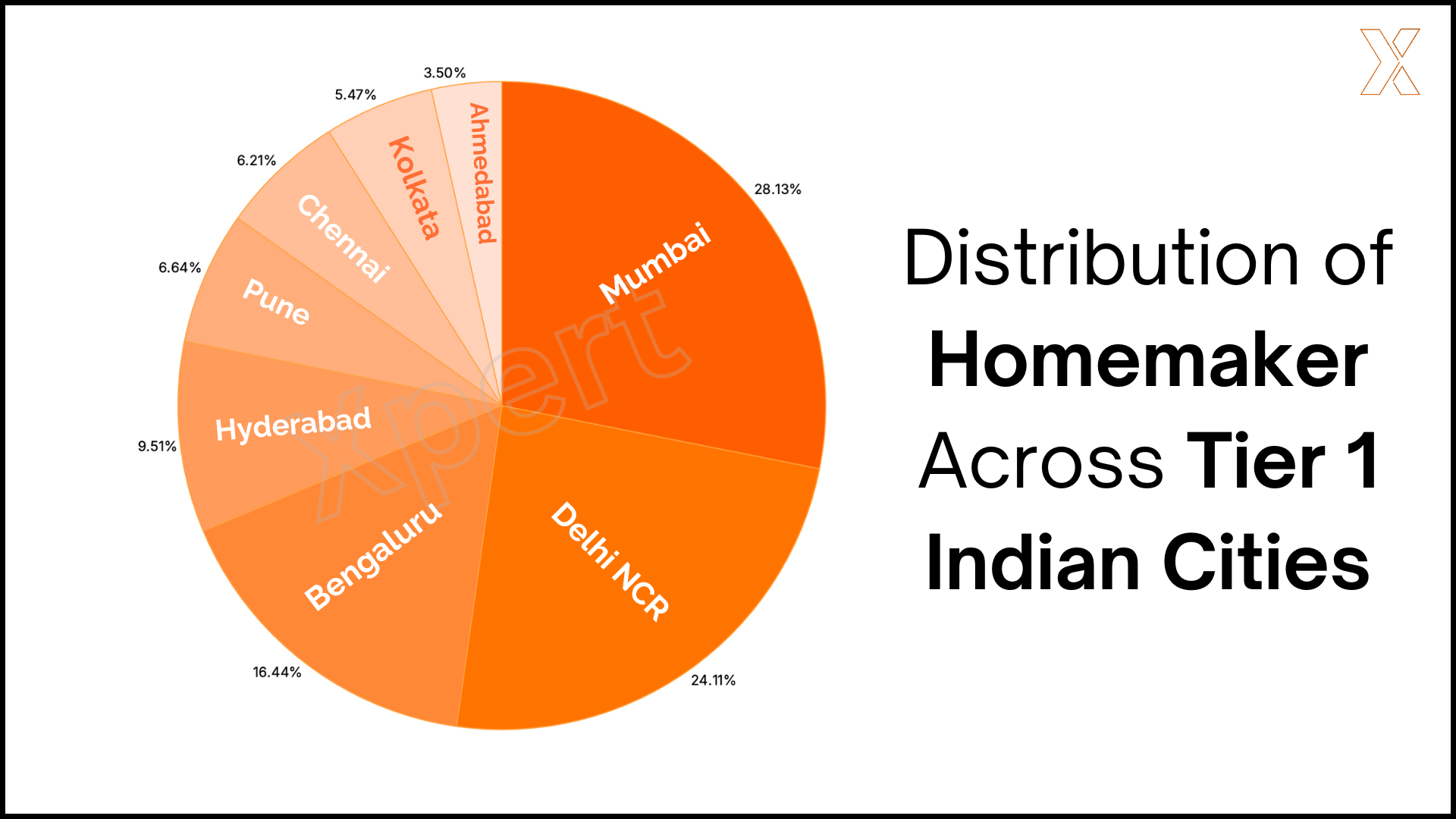

Across Tier 1 cities, just 22% of localities house 80% of premium homemaker buyers. These high-density zones are critical for store placement, marketing, and distribution.

Let’s look at a few examples from the report:

Mumbai

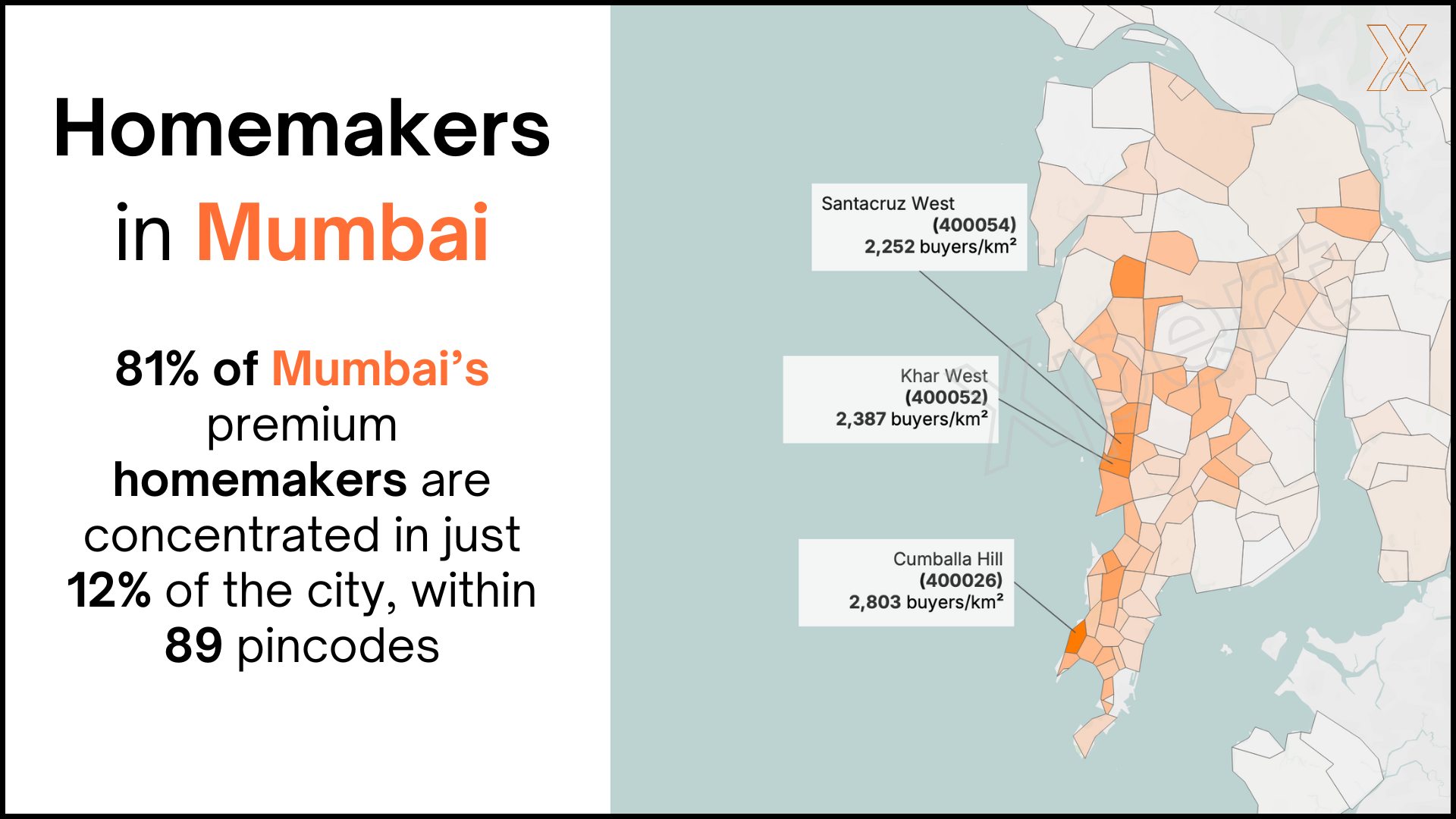

81% of the city’s premium homemakers are concentrated in just 12% of the city.

Top Pincodes by Buyer Count:

- 400053 (Andheri West) – 2.77%

- 400050 (Bandra) – 1.88%

Top Pincodes by Density: - 400026 (Cumballa Hill) – Score 5

- 400052 – Score 2.4

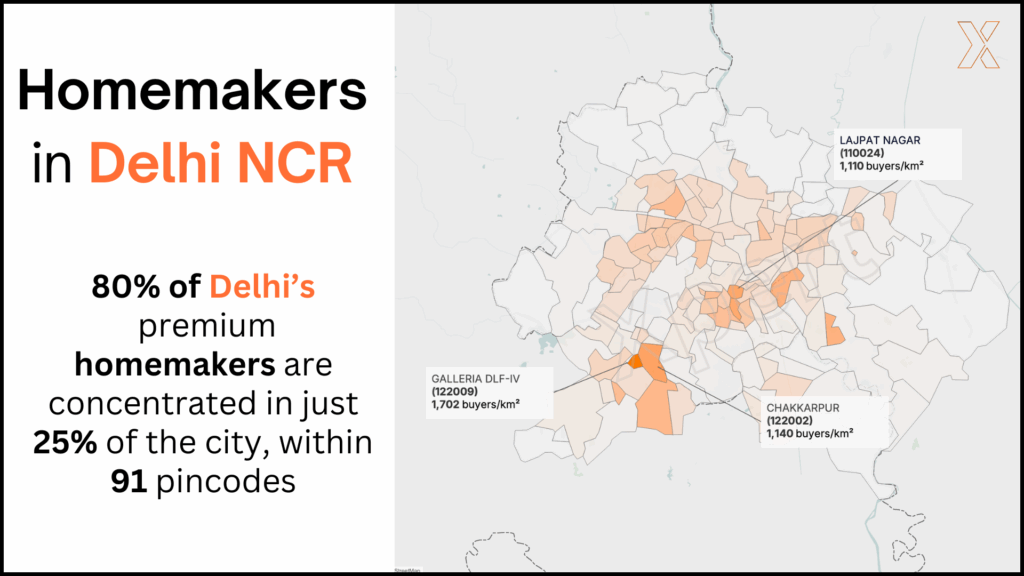

Delhi NCR

80% of homemakers are found in just 25% of the city across 91 key pincodes.

Top Pincodes:

- 201301 (Noida) – 5.59%

- 122001 (Gurgaon) – 4.54%

High Density Zone: - 122009 (DLF Phase 5) – Score 5

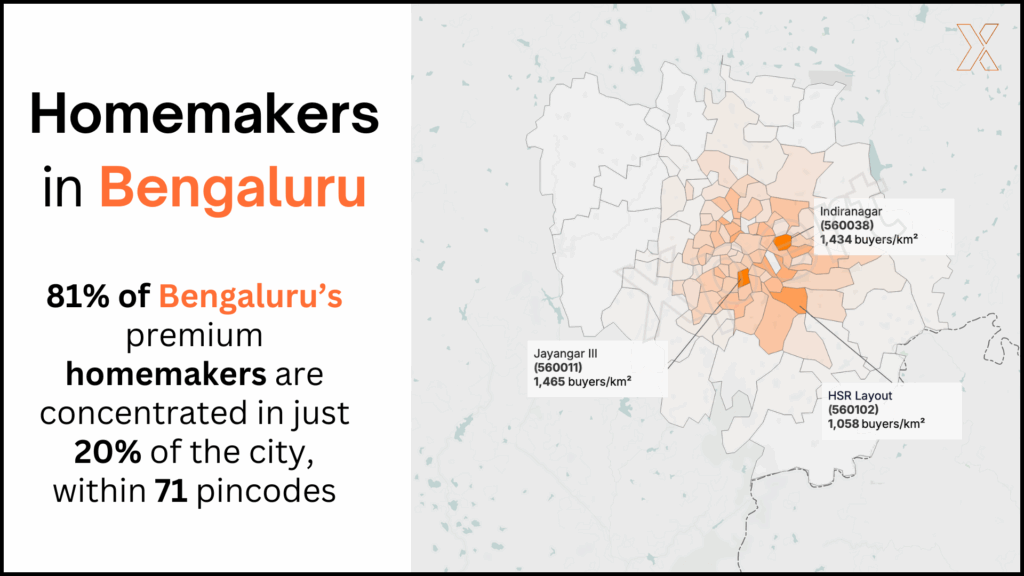

Bengaluru

81% of buyers are concentrated in just 20% of the city.

Top Pincodes by Buyer Count:

- 560037 (Marathahalli) – 4.10%

- 560076 – 4.06%

Top Density Pincodes: - 560011 (Jayanagar) – Score 5

- 560038 (Indiranagar) – Score 4.8

What Motivates Homemaker Purchases?

Understanding why homemakers buy is just as important as knowing where they live.

Our findings show:

- Tier 1 homemakers are 3X more likely to purchase home décor online, signaling their comfort with premium e-commerce and brand discovery.

- Tier 2/3 homemakers show stronger interest in lawn and garden categories, indicating an evolving rural-to-urban shift in home ownership and aspirations.

- Over 40% of premium homemakers are health-conscious, influencing their spend on groceries, cleaning products, and wellness goods.

These motivators offer direct cues to brands on how to position SKUs, tailor pricing, and plan product education or storytelling.

How This Report Helps You Target Smarter

This report isn’t just about audience definition—it’s about distribution precision and marketing focus. It can help brands:

- Identify high-potential GT/MT stores based on homemaker density

- Launch EBOs in neighborhoods with higher revenue projections

- Optimize digital branding by targeting verified homemaker clusters

- Run hyperlocal campaigns that resonate with their lifestyle preferences

- Improve media spend ROAS by focusing only on locations with real buying power

Conclusion: Rethink Homemaker Targeting with Real Buyer Data

For brands across food, homecare, wellness, and décor—homemakers remain a critical consumer. But most strategies still assume they’re one homogenous group.

The truth is, homemakers in India differ dramatically by city, pincode, and purchase intent.

By understanding who they are, where they live, and what drives them, your brand can unlock smarter retail decisions and more resonant storytelling.

About Xpert

At Xpert, we track 12M+ verified buyers across India to help brands understand their customers through what matters most—their purchases.

From identifying micro-market hotspots to building smarter ad audiences, we help brands shift from assumptions to insight.

Learn more at www.xpert.chat