Are you a skincare or makeup brand looking to build your retail presence across India? But unsure which cities and markets to enter first? Which malls, high streets, and GT/MT stores drive the highest beauty footfalls? Which localities, areas, and pincodes have the highest beauty buyer potential?

While census data highlights regions with high population density, the reality is that less than 5% of Indians account for over 95% of discretionary beauty purchases—meaning Population Density ≠ Buying Density.

And while brands often rely on sales teams and competitor locations to validate top cities and stores, these methods are driven by intuition, not actual consumer behavior.

What if you could base your retail expansion strategy on how real skincare & makeup buyers in India shop, rather than relying on assumptions?

Which is why we recently published Xpert’s Cosmetics Buyers Insight Report—a data-driven approach that identifies which districts, pincodes & retail locations enjoy the highest demand for beauty brands, helping you refine your retail expansion strategy.

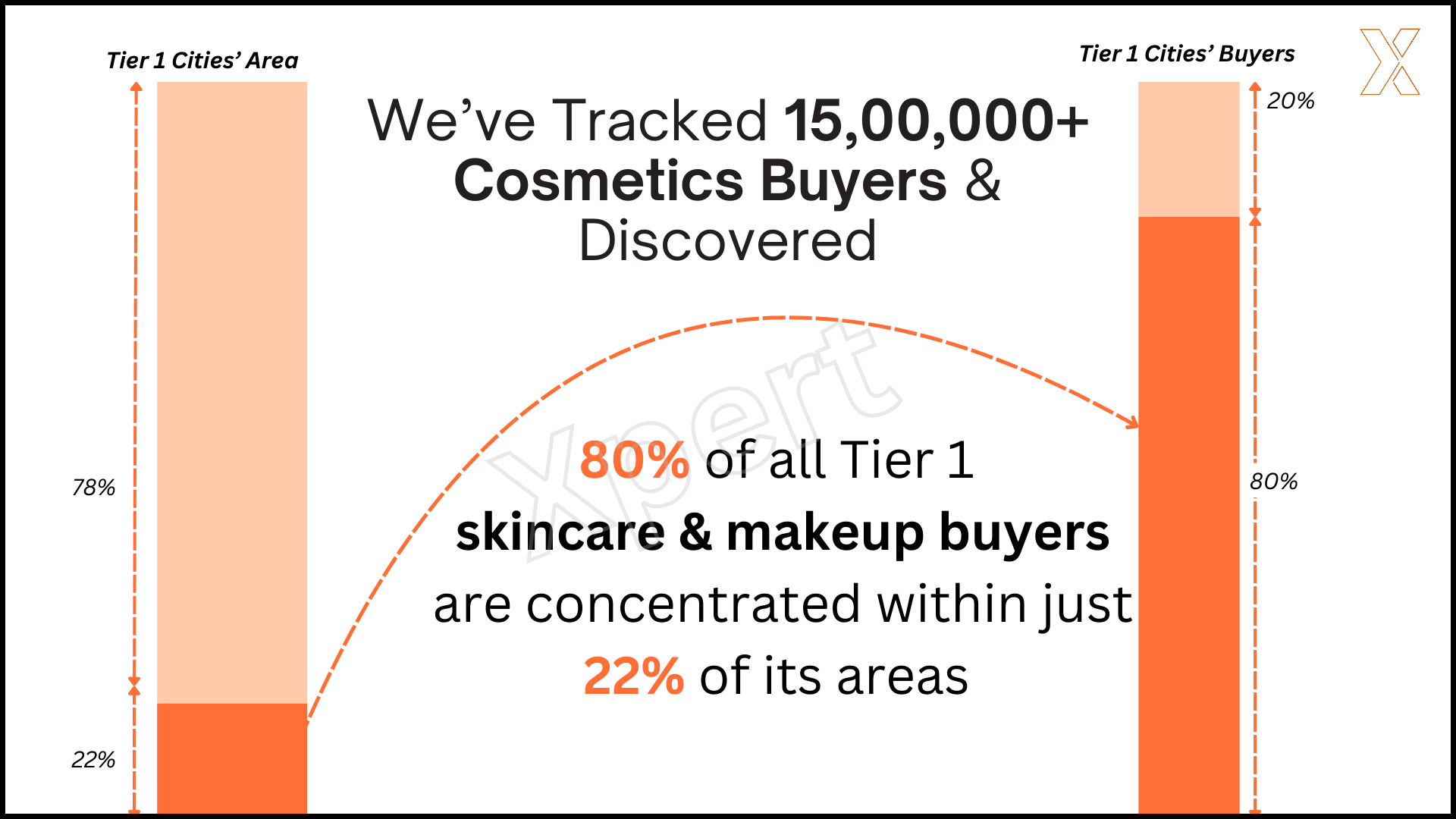

Our data source? We’ve analyzed retail POS and digital purchases from over 1.5 million unique cosmetics buyers, spanning 500+ brands and 19,000+ pincodes, to pinpoint exactly where beauty buyers are concentrated—down to specific areas, localities, and stores.

Our insights go beyond just footfall data—we reveal real purchase trends, showing how buyer preferences vary by location, affluence, and purchase behavior.

The report aims to capture invaluable locational insights about India’s beauty buyers—insights that go beyond just measuring store footfalls. Stop relying on guesswork—start making data-backed decisions!

In the Xpert Cosmetics Buyers Insight Report, You’ll Uncover:

This article highlights key findings from the report, helping skincare & makeup brands understand:

- The top-performing locations for beauty sales.

- Pincode-level insights to avoid oversaturated markets.

- City-tier breakdowns of what’s selling and where.

- Where the highest-value customers are concentrated.

- Where should you expand next? — Identifying the most profitable markets and pincodes for new store openings.

- Which 20% of pincodes drive 80% of your sales? — Focusing on high-impact areas with dense buyer activity within a city.

- Which malls attract the most buyers? — Discover the top beauty buyer hotspots with strong foot traffic and conversion potential.

- Which locations have the highest revenue potential? — Align your retail expansion strategy with buyer concentration and spending power.

- What skincare & makeup products are in demand—and where? — Understanding how beauty shopping preferences vary across different city tiers.

- What drives your target customers’ purchases? — Understanding how buying preferences, identity traits, and affluence levels impact product assortment & messaging.

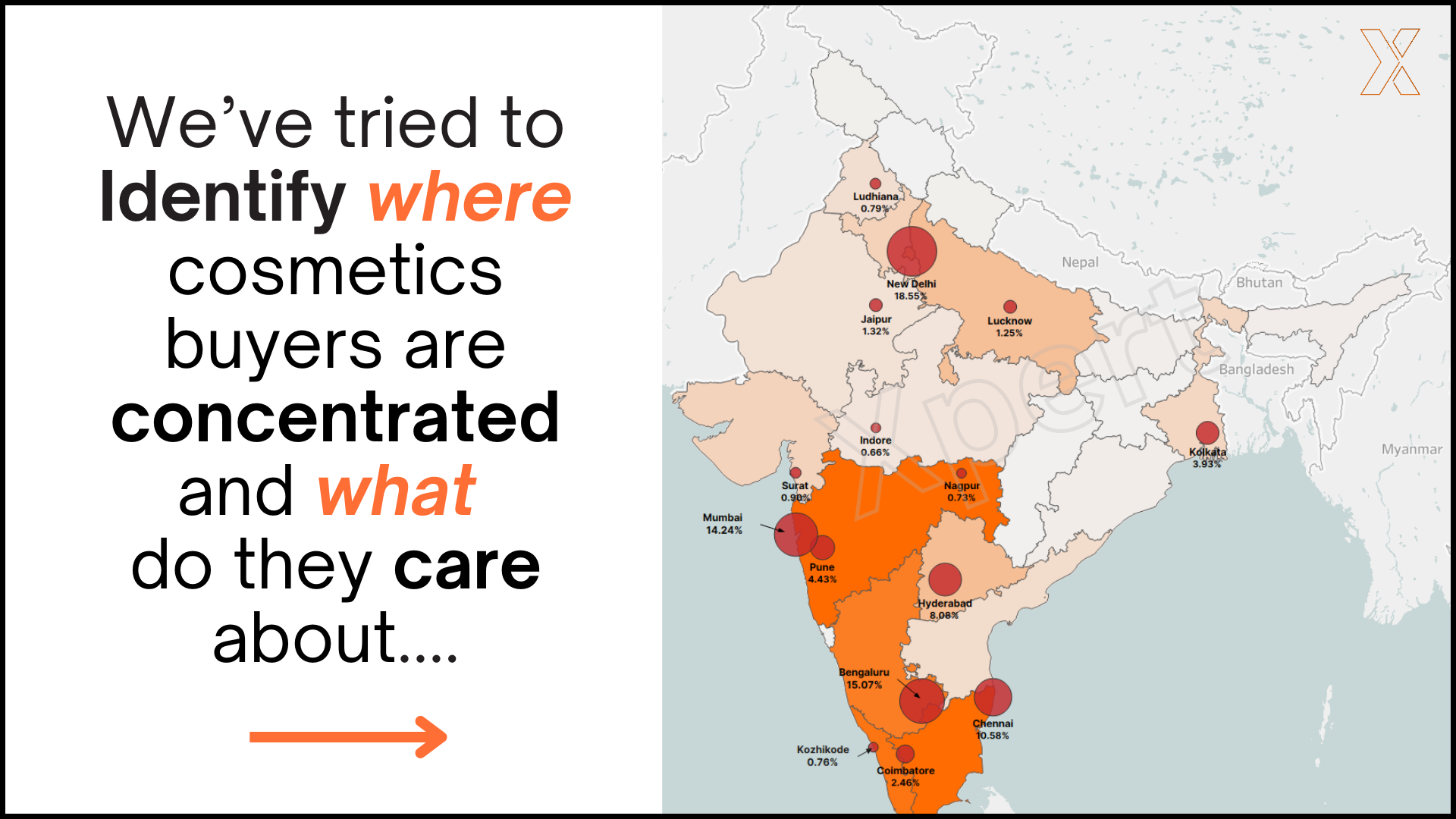

Where Are India’s Skincare & Makeup Buyers Located?

Beauty buyers are highly concentrated in specific areas—expanding blindly where your target customers are sparse can result in wasted marketing spends and underperforming stores.

Our research uncovers:

– 80% of skincare & makeup buyers are concentrated in just 22% of areas in Tier 1 cities.

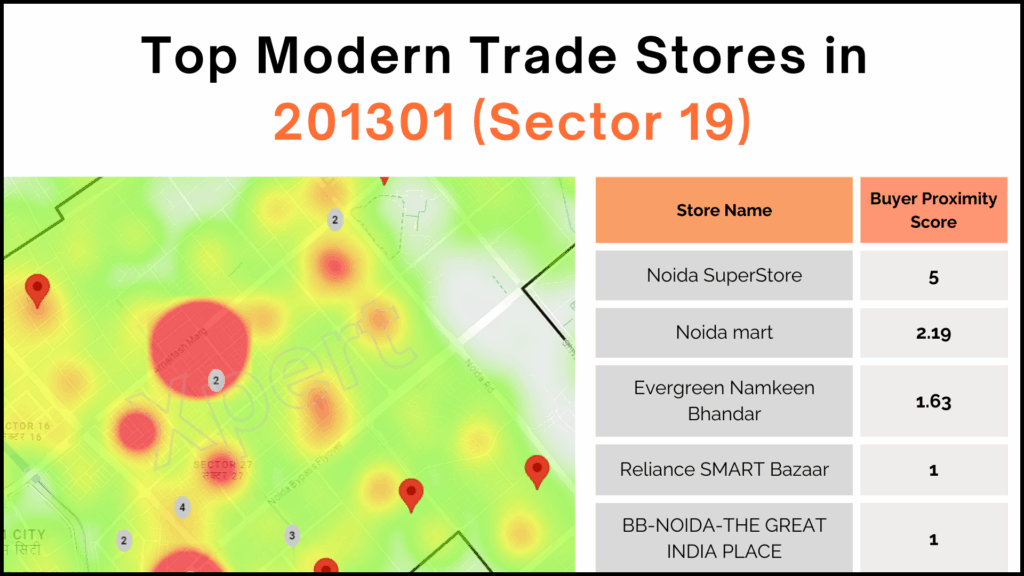

– Highest buyer density pincodes—ideal for GT/MT store partnerships & EBO expansion.

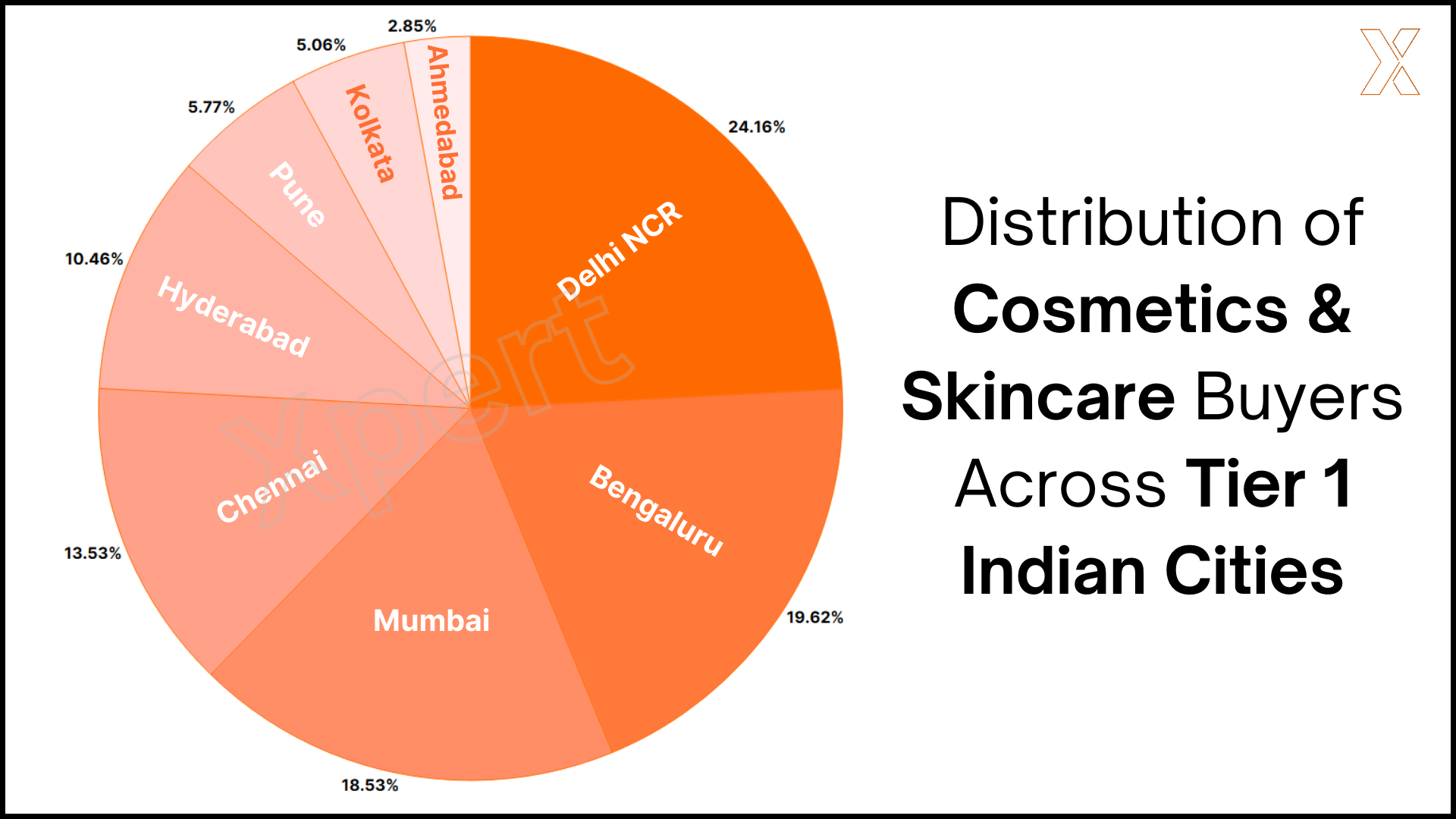

– City-wise breakdowns for key metros like Delhi-NCR, Mumbai, Bengaluru, Chennai, Pune, and Hyderabad.

For instance, in Delhi NCR, 80% of beauty buyers are concentrated in just 24% of the city, across 91 key pincodes.

For skincare & makeup brands, these insights help prioritize high-converting locations and avoid costly expansion mistakes.

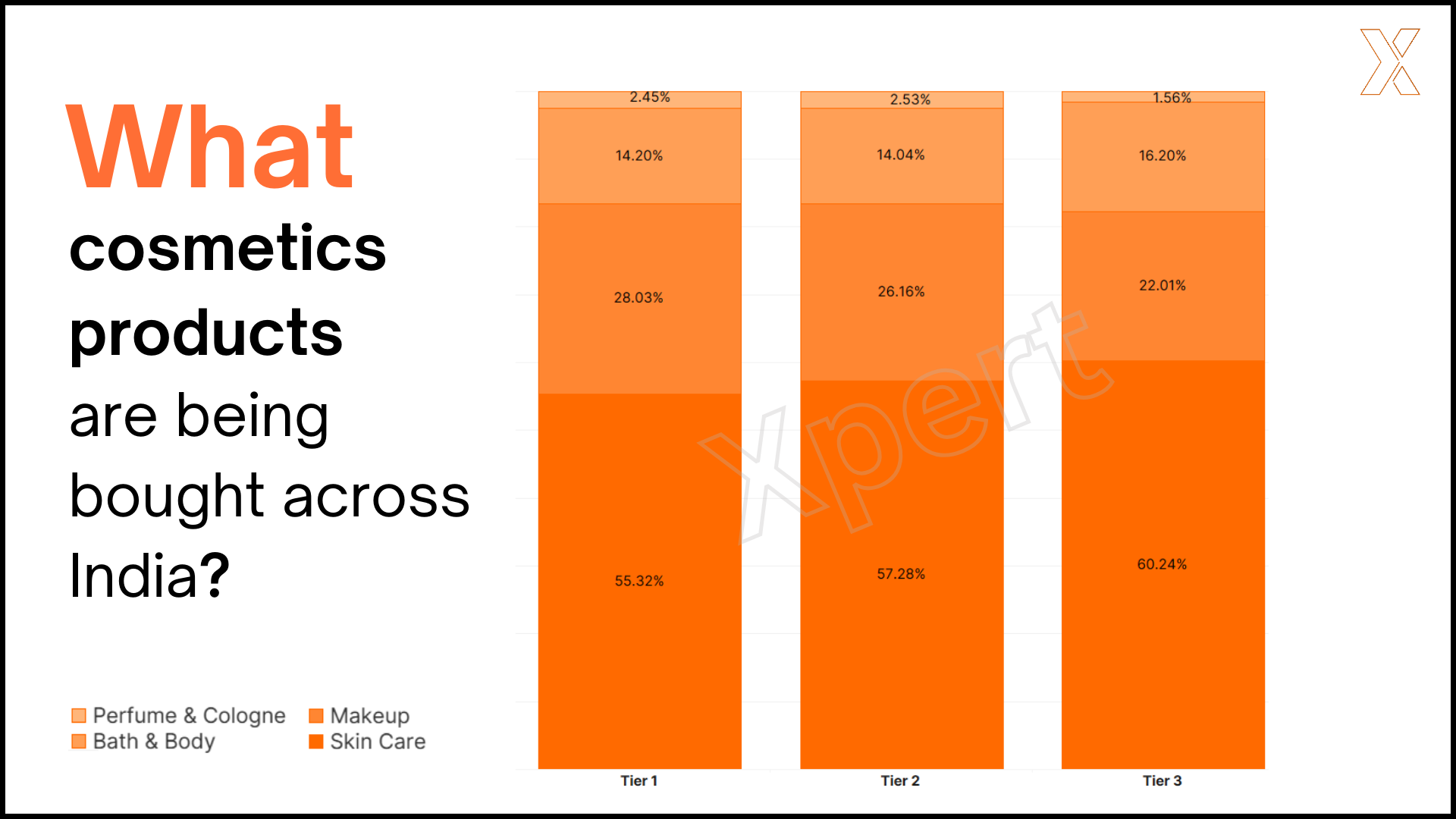

What Are India’s Beauty Buyers Purchasing?

Consumer preferences vary significantly across city tiers. Understanding these trends can help brands optimize inventory and tailor marketing strategies.

Our research highlights:

– Tier 1 buyers show a stronger preference for premium skincare, serums, and anti-aging products.

– Tier 2 and 3 buyers lean more toward mass-market face creams, lipsticks, and herbal skincare.

– Makeup, active skincare, and dermaceuticals are rapidly growing categories across all city tiers.

For beauty brands, this means:

– Stocking up on the right inventory per location.

– Positioning premium vs. budget collections strategically.

– Customizing online vs. offline pricing strategies.

How This Report Helps Beauty Brands Expand Smarter

This report is not just a market analysis—it’s a strategic tool designed to help skincare & makeup brands:

– Pinpoint high-growth retail locations with proven buyer demand.

– Optimize inventory planning based on actual consumer behavior.

– Find the best catchment areas for new store openings.

– Identify untapped opportunities before competitors do.

How Can This Report Help Refine Your Retail Strategy?

With beauty consumer preferences shifting rapidly, brands that leverage real purchasing data will outperform those relying on traditional expansion methods. By analyzing actual buyer transactions, we’ve mapped out the strongest skincare & makeup markets, identifying where brands should focus their retail and marketing efforts.

We’ve also analyzed cosmetics purchasers across Bengaluru, Delhi, Mumbai, Pune, Chennai, Hyderabad, Gurgaon, Ahmedabad, Noida, and Kolkata.

Stop relying on guesswork—Download the Xpert Cosmetics Buyers Insight Report now and unlock data-backed insights to drive smarter retail expansion.

About Xpert

At Xpert, we track omni-channel purchases across 12M+ Indians to help brands better target their marketing and scale smarter.

With real-time data on where buying happens—not just browsing—we enable brands to reduce guesswork and unlock untapped demand across cities.

Learn more at: www.xpert.chat