Planning to grow your retail footprint across East India? But not sure if you should bet on Bhubaneswar, Guwahati, or somewhere smaller like Asansol?

Most expansion plans focus on population size. But here’s the catch—only a small slice of India’s population makes the majority of non-essential purchases. So if your strategy is built on population heatmaps, you might be opening stores in the wrong places.

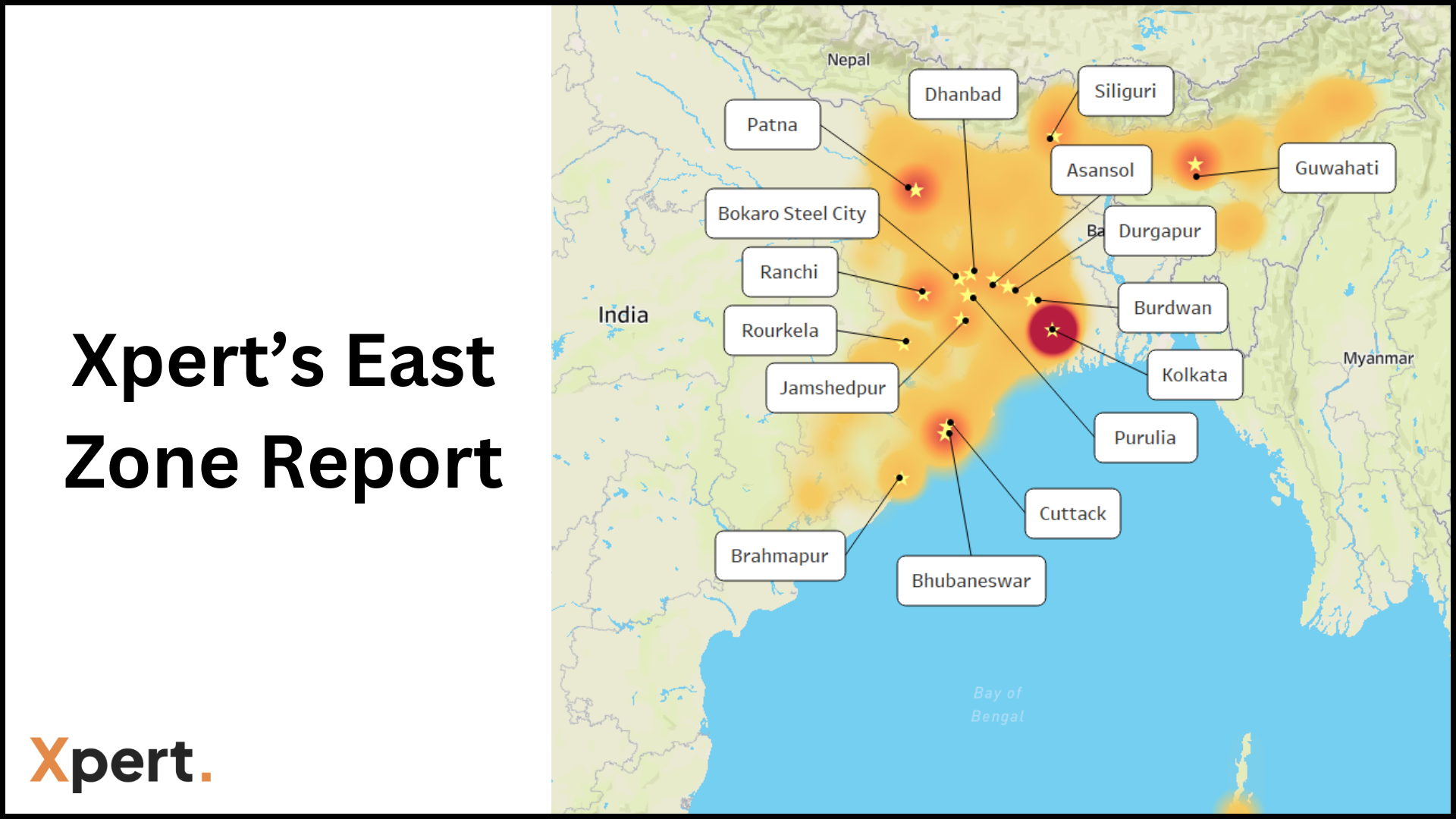

That’s why we created Xpert’s East India Buyers Insight Report 2024—a deep dive into where real shopping happens across West Bengal, Odisha, Assam, and Jharkhand. Based on actual spending data, this report helps brands get hyperlocal and make decisions rooted in buying density—not just people density.

We tracked over 2.1 lakh buyers across Tier 1 to Tier 4 towns in East India using data from online orders, offline store checkouts, and brand loyalty programs.

Inside the Xpert East India Report:

- Top 10 retail zones contributing to the majority of East India’s purchases

- State-wise breakdown of high-demand categories and emerging hotspots

- How East Indian buyers differ from national shopping patterns

- Actionable insights for retail footprint, hyperlocal ads, and product assortment

East India’s Shoppers: Who Are They Really?

Shoppers here aren’t homogenous—they vary widely by state, city size, and even neighborhood. But a few patterns stand out.

- Odisha shoppers tend to be more digitally savvy and convenience-driven. App-first categories like food delivery, electronics, and cosmetics are growing fast.

- Jharkhand buyers show strong family-oriented shopping behavior—think groceries, apparel, and education-related spends.

- West Bengal continues to be culturally driven. Fashion, personal care, and seasonal shopping spikes around Durga Puja dominate patterns.

- Assam buyers—especially in Guwahati—are price-conscious but aspirational. Affordable fashion, electronics, and QSR chains are doing well.

Let’s zoom in on some of the most interesting micro-markets.

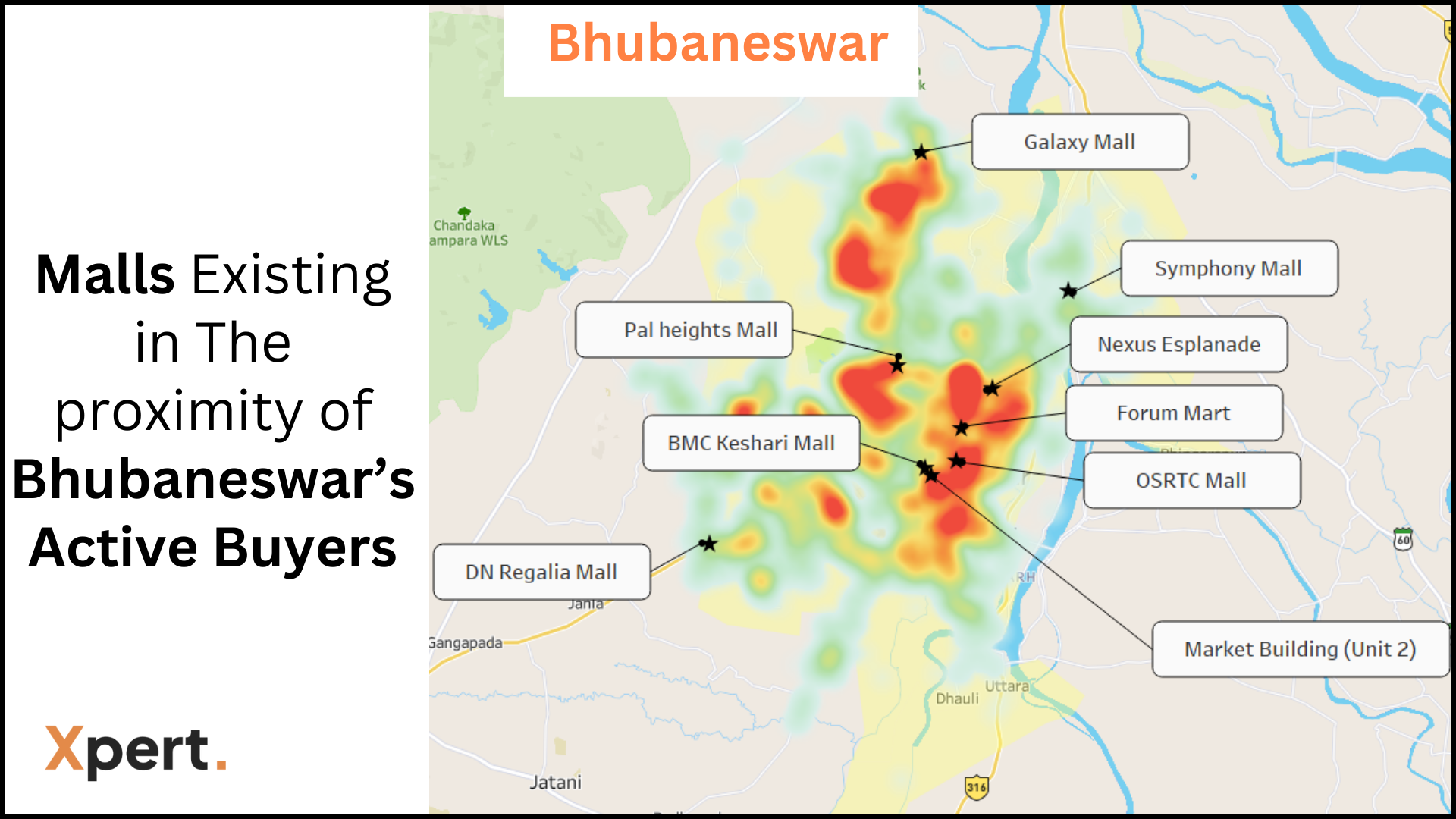

Bhubaneswar: The Underrated Metro

With a population just crossing 10 lakhs, Bhubaneswar might not look like a traditional tier-1 city—but the spending patterns say otherwise.

- Where people shop: Esplanade Mall, DN Regalia, Janpath Market, Master Canteen

- What sells: Electronics, beauty, fashion, groceries

- Real-life signal: D2C brands are seeing repeat orders from Bhubaneswar faster than bigger cities. Consumers here are responsive to both offline experiences and digital-first launches.

Perfect For: Brands with mid-to-premium SKUs who want early-mover advantage in an efficient city.

Ranchi: The Rising Heartland Shopper

Jharkhand’s capital city is quickly evolving—while still holding onto traditional values. Think a mix of mall shopping and haat-bazaar mentality.

- Top areas: Hinoo, Ashok Nagar, Harmu, Lalpur

- What sells: Apparel, kidswear, family electronics (TVs, refrigerators), daily essentials

- Real-life example: Brands with EMI options or monthly subscription models do well—this crowd prefers staggered payments for big-ticket items.

Perfect For: Mass-market retailers and electronics brands that offer affordability and value.

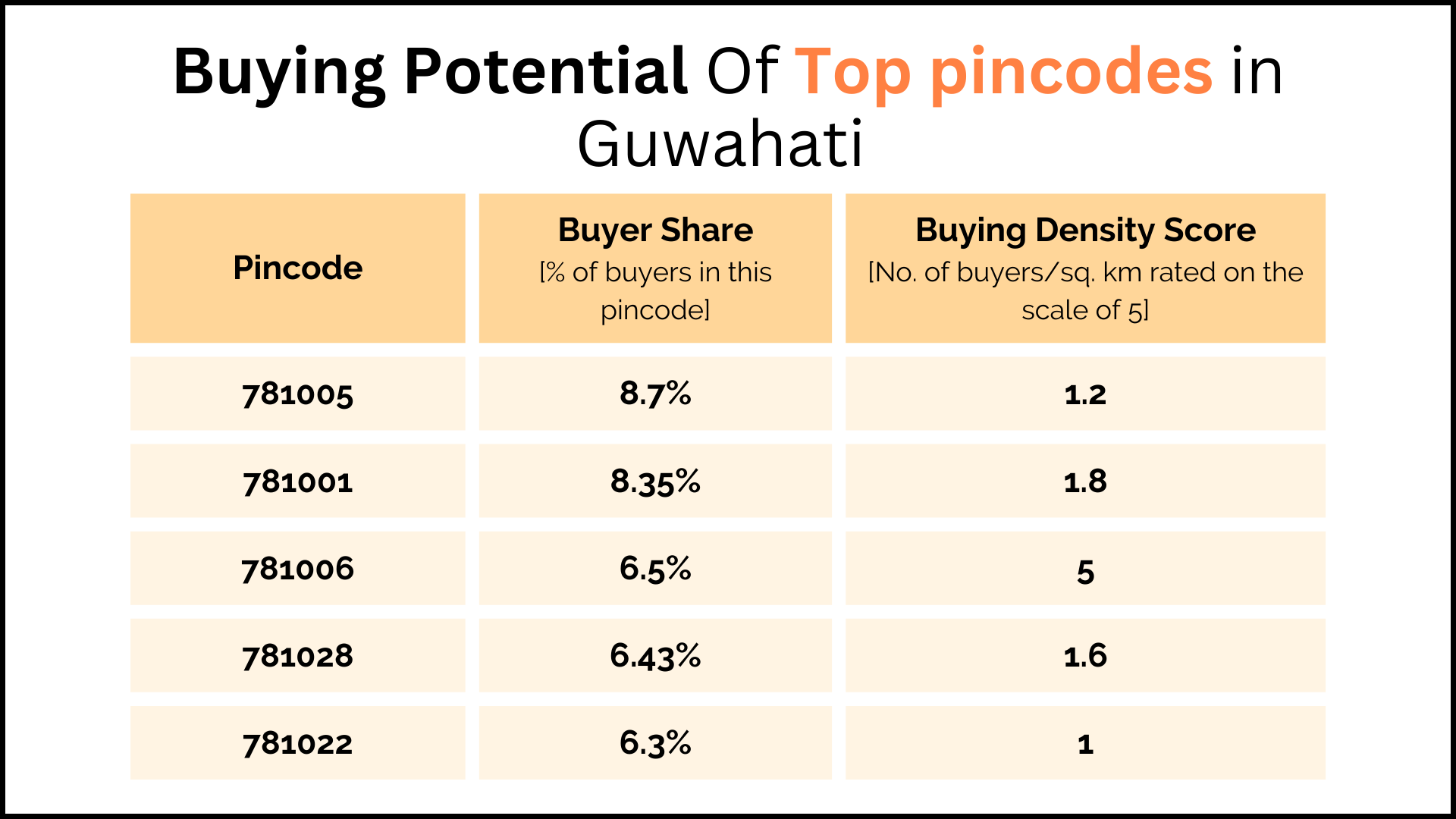

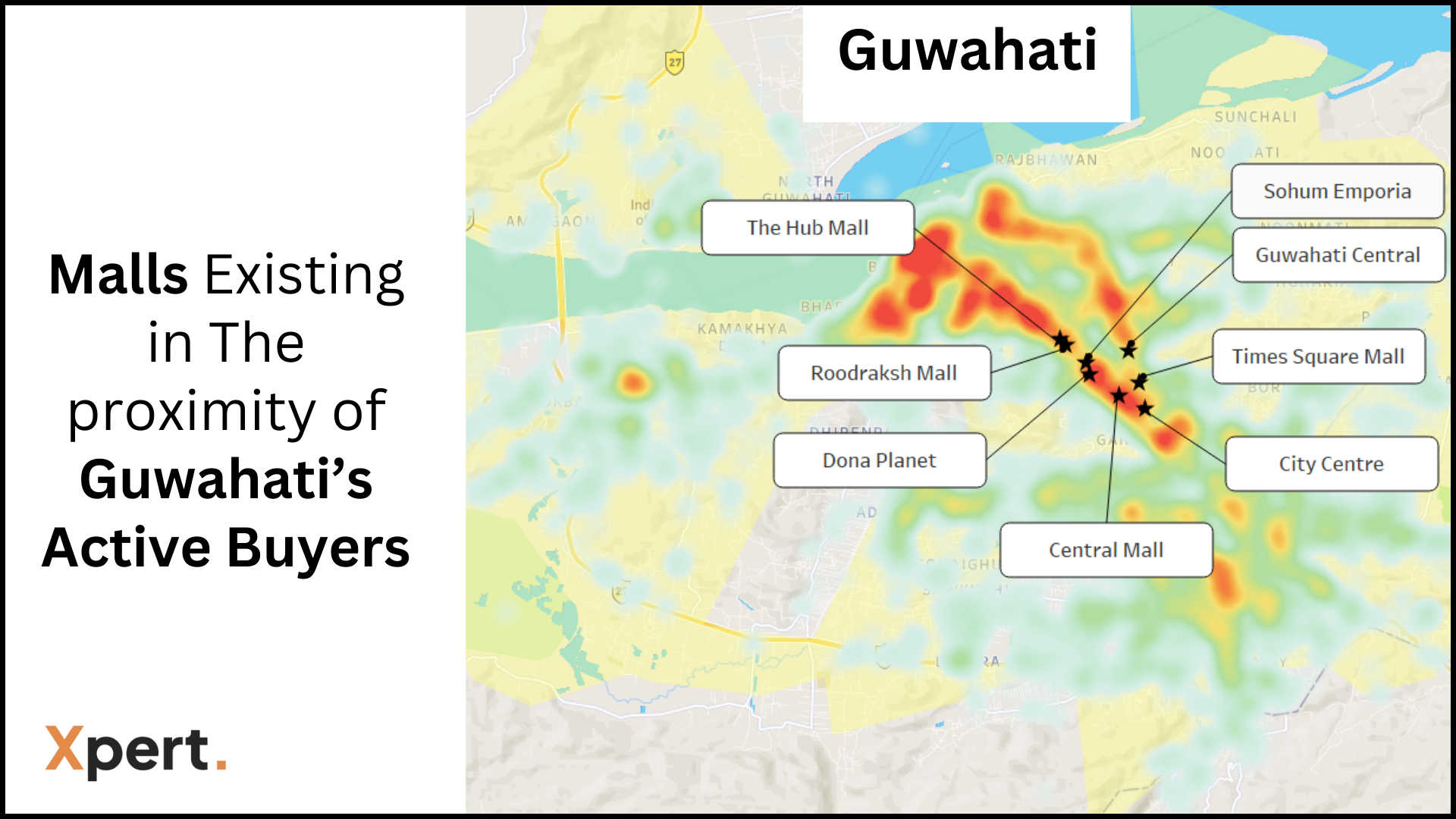

Guwahati: The Northeast’s Fashion Capital

Fashion-forward yet price-sensitive, Guwahati is East India’s most exciting Tier 2 shopper city.

- Top zones: GS Road, Six Mile, Paltan Bazaar, Pan Bazaar

- What sells: Budget fashion, affordable tech, snacks, footwear

- Fun fact: Guwahati has a strong college-going population. Gen Z and young professionals drive online shopping here, especially during flash sales and offer periods.

Perfect For: Affordable fashion, QSRs, cosmetics, and any D2C brand running influencer campaigns in the Northeast.

Siliguri: The Gateway Shopper City

Though it’s a Tier 3 city, Siliguri is a shopping hub for all of North Bengal and parts of Sikkim. It’s a transit town—but with loyal buyers.

- Top areas: Hill Cart Road, Sevoke Road, City Centre

- What sells: Daily use categories like grocery, personal care, utility electronics

- Local insight: Many buyers here aren’t buying for just their own family—but for relatives in smaller towns nearby. Bulk and utility wins.

Perfect For: FMCG, healthcare, and regional brands that serve 2nd and 3rd circle influence.

Are East India Buyers Price Sensitive?

Yes—but not in the way you think.

Eastern Indian buyers aren’t just “bargain hunters.” They’re value-aware. They’ll spend more—but only if the value is clear.

For instance:

- A Guwahati shopper might skip a ₹2,000 jacket in-store, but order it online during a 40% off sale with free returns.

- A Bhubaneswar buyer will choose a ₹50 facial cleanser over a ₹20 one—but only if the packaging and reviews signal better quality.

- In Ranchi, families opt for EMI-based purchases even for kitchen appliances, signaling openness to larger spends—but in controlled formats.

So, don’t assume price = resistance. Instead, make value, reviews, bundles, and after-sales support part of your strategy.

How This Report Helps Retailers

- Spot the top 10 high-intent shopping zones in East India

- Understand what categories are gaining traction where

- Run smarter campaigns—don’t spend blindly on population heatmaps

- Launch stores and SKUs based on real buying data

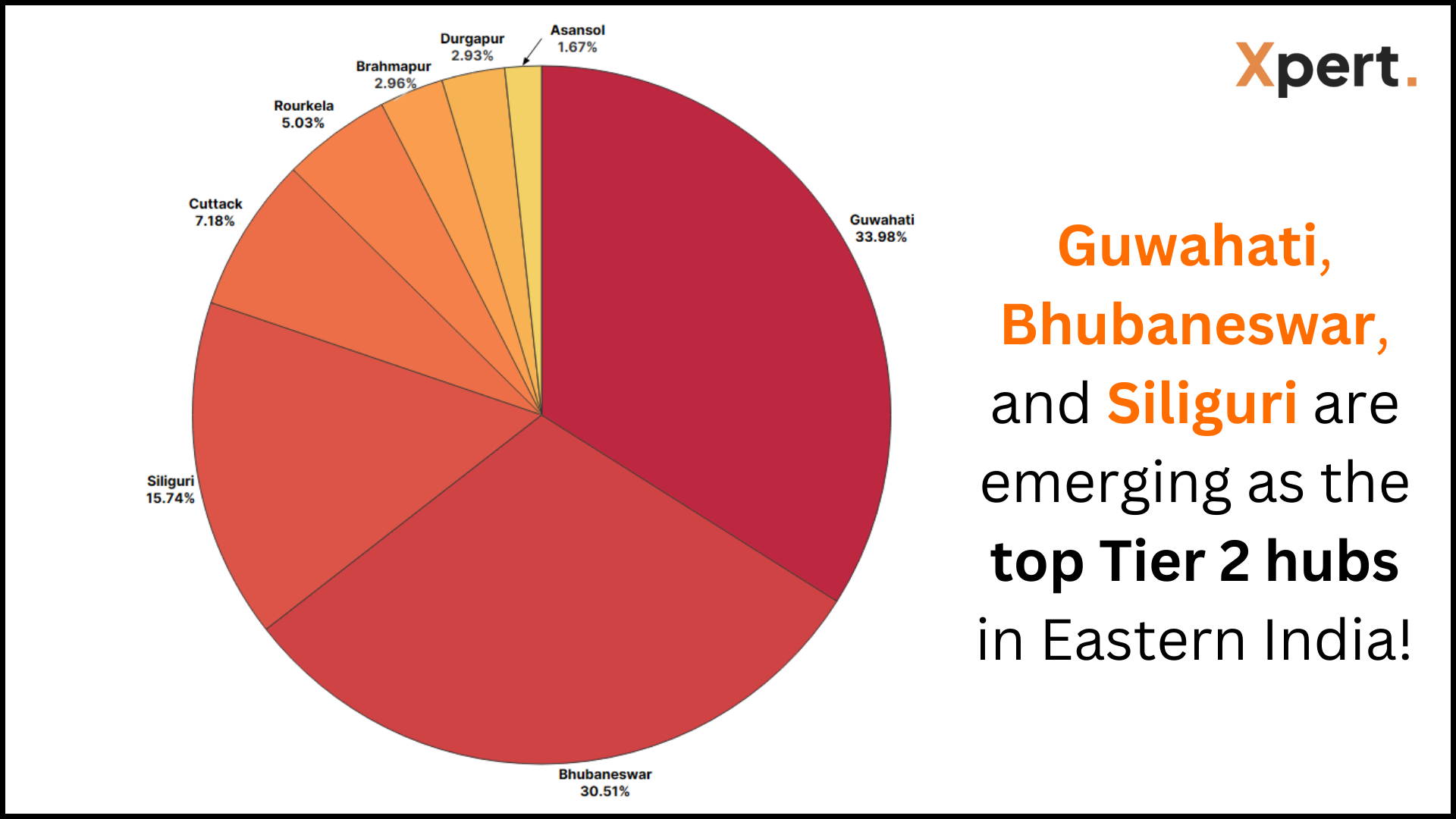

Use Case: A cosmetics brand used this data to identify where to scale Tier 2 retail counters. Turns out, Guwahati, Durgapur, and Bhubaneswar were outperforming metros in terms of SKU rotation.

Don’t waste budgets targeting non-buyers. Go where the wallets are.

Download the full East India Buyers Insight Report 2024 now

About Xpert

At Xpert, we track omni-channel purchases across 12M+ Indians to help brands better target their marketing and scale smarter.

With real-time data on where buying happens—not just browsing—we enable brands to reduce guesswork and unlock untapped demand across cities.

Learn more at: www.xpert.chat