Are you a brand looking to expand your retail presence in Mumbai but struggling to figure out which areas actually drive sales? Identifying the right localities and pincodes is crucial—but how do you separate hype from actual buying demand?

Census data might show where people live, but retail success isn’t about population density—it’s about buying density. With fewer than 5% of Indians driving over 95% of discretionary purchases, relying solely on footfall numbers can be misleading.

Competitor locations and sales team insights might offer guidance, but these are often based on intuition rather than hard data. To make truly strategic decisions, you need insights directly linked to your actual buyers—where they shop, what they purchase, and how frequently they spend.

That’s why we put together Xpert’s Mumbai Buyers Insight Report—a comprehensive breakdown of consumer shopping patterns across the city, helping brands like yours expand strategically and profitably.

Where Did We Get the Data?

We tracked 260K+ Mumbai shoppers across 280+ brands, analyzing both online and offline retail purchases to uncover WHERE they are concentrated and WHAT they are buying.

What’s Inside the Xpert Mumbai Buyers Insight Report?

- Where should you open next? — Identify Mumbai’s most profitable retail markets and pincodes.

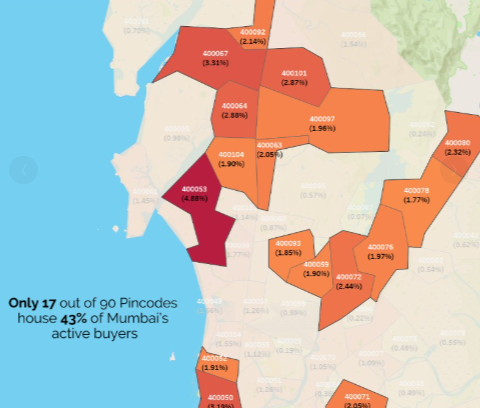

- Which 17 pincodes house 40%+ of Mumbai’s buyers? — Prioritize high-impact areas instead of spreading thin.

- Which malls actually drive purchases? — Find out which retail hubs generate real revenue.

- Which locations have the biggest spending power? — Align your expansion strategy with actual buying capacity.

- What do Mumbaikars look for when shopping? — Understand their price-conscious mindset to fine-tune your product offerings.

Mumbai Buyers: What Surprised Us?

We expected Mumbai to be a retail giant, but some insights were eye-opening:

Just 17 out of Mumbai’s 90 pincodes account for 43% of the city’s active buyers.

Even more surprising? These buyers are highly concentrated in just 5 key neighborhoods!

If you’re a retail brand looking to scale, wouldn’t you want to know exactly where these top-performing areas are? Instead of investing in expensive locations that don’t perform, you can focus your budget on areas that actually drive sales.

What Are Mumbaikars Buying?

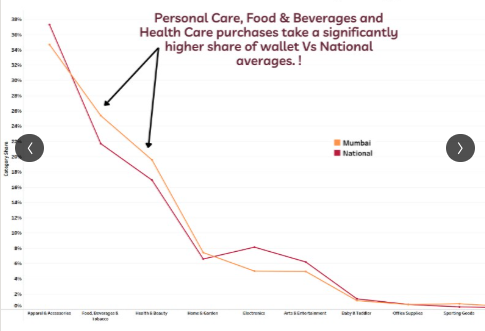

Mumbai is a city with distinct shopping habits that set it apart from the national average. Our latest purchasing insights reveal that Mumbaikars allocate a significantly higher share of their wallets to Personal Care, Food & Beverages, and Health & Beauty products compared to the national average.

But what does this mean for brands looking to expand in Mumbai? Let’s dive into the key trends:

- Higher Spending on Essentials & Well-Being

Compared to the rest of India, Mumbai buyers prioritize self-care and daily consumption goods:

- Personal Care & Health: Spending on beauty, wellness, and healthcare is noticeably higher, reflecting an urban consumer base that values self-care and premium wellness products.

- Food & Beverages: The city’s fast-paced lifestyle and strong food culture drive higher spending in this category. Brands in F&B, especially those catering to convenience-driven consumption, stand to gain in Mumbai.

- Apparel & Accessories Still Lead, But the Gap Narrows

While Apparel & Accessories continue to dominate spending, Mumbai’s allocation to this category is only slightly above the national average. This indicates that while fashion remains a priority, consumers are diversifying their spending across other lifestyle categories.

Are Mumbaikars Price Sensitive?

Despite having the highest per capita income, Mumbai shoppers are savvy spenders who prioritize value for money.

Think about Dadar’s bustling street markets versus Palladium’s luxury stores—Mumbaikars want the best deals, no matter where they shop. If your pricing doesn’t match perceived value, they will move on.

Where Are Mumbai’s Most Active Shoppers?

If you want to target Mumbai’s top spenders, focus on these neighborhoods:

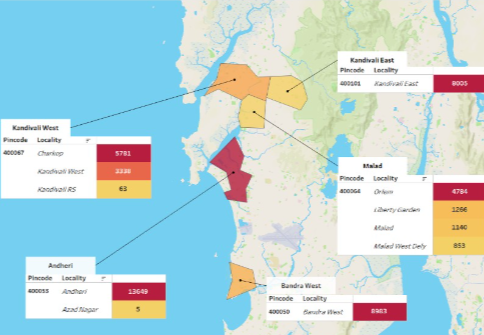

- Andheri (400053) leads with 13,649 purchases – a major retail hub.

- Bandra West (400050) follows with 8,983 purchases – known for premium shopping.

- Kandivali East (400101) records 8,005 purchases, showing strong demand.

- Kandivali West (400067) sees high activity, especially in Charkop (5,781 purchases).

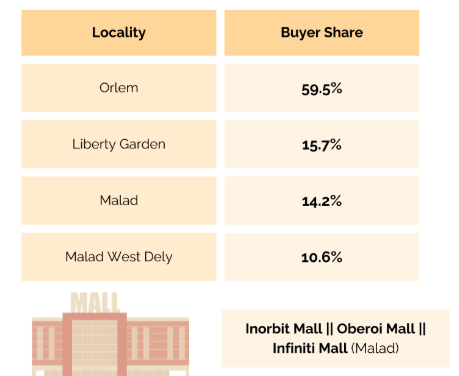

- Malad (400064) completes the list, with Orlem contributing 4,784 purchases.

Where Do Mumbaikars Actually Shop?

Mumbai’s malls aren’t just about shopping—they’re a way of life. But not all malls are equal. Some bring in high-intent buyers, while others are filled with window shoppers.

For example here are Malad’s Top Malls for Retail Success:

- Inorbit Mall – A powerful mix of premium and mass brands.

- Oberoi Mall – Ideal for high-end retail and lifestyle shopping.

- Infiniti Mall (Malad) – Highest footfall with the best conversion rates.

For brands setting up pop-ups, in-store activations, or marketing campaigns, choosing the right mall is key to maximizing return on investment.

How This Report Can Transform Your Retail Strategy

- This isn’t just another market analysis—it’s a blueprint for success:

- Pinpoint high-growth areas before your competitors do.

- Discover new catchment areas to target the right audience.

- Optimize inventory and avoid stock imbalances.

- Uncover untapped opportunities that most brands overlook.

Ready to Take the Guesswork Out of Mumbai’s Retail Landscape?

About Xpert

At Xpert we track omni-channel purchases across 12M+ Indians to help brands better target their marketing & scale their distribution.

Leveraging our data brands are able to optimize their marketing spends, strategically scale their retail expansion & identify demand blindspots.

Here’s more about us : www.xpert.chat