Planning to scale your GT (General Trade) distribution across Mumbai?

The usual question is: which stores get high footfall?

But we’d argue there’s a better one to ask:

Which stores are closest to the buyers that actually drive demand?

At Xpert, we’ve created the Mumbai GT Distribution Report 2025 to help brands plan smarter, not wider. This is not just a store directory—it’s a map of where your demand lives.

The Real Problem: Sales Data from GT Stores Isn’t Public

So how do you know which GT stores your brand absolutely needs to be in?

We tackled this using a reverse approach: instead of looking at store performance, we started with buyer demand.

Here’s how we built the report:

- Identified over 6 lakh verified Mumbai buyers using their real omnichannel purchases across 500+ brands in F&B, Grocery, Beauty, Health, and Apparel.

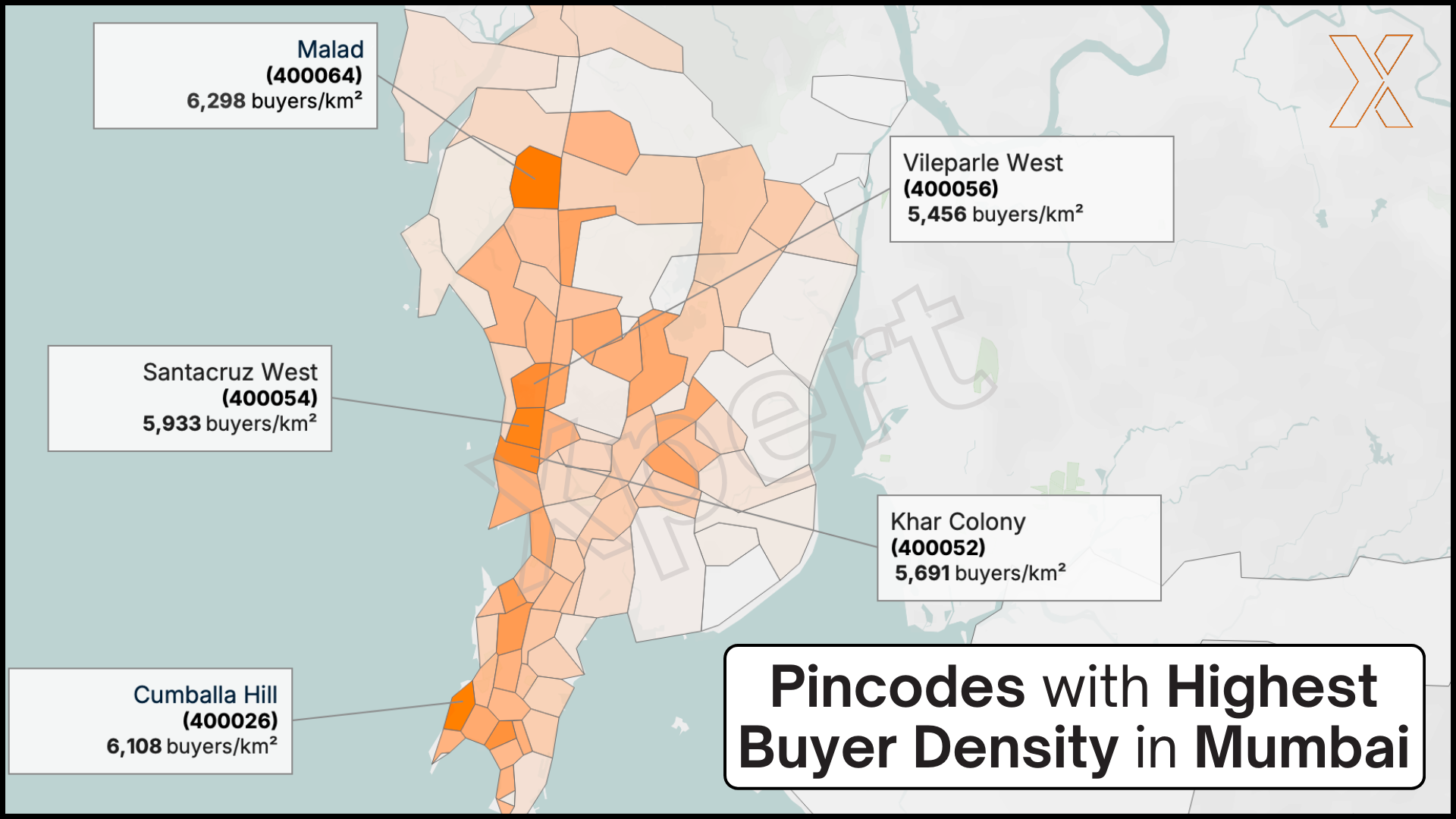

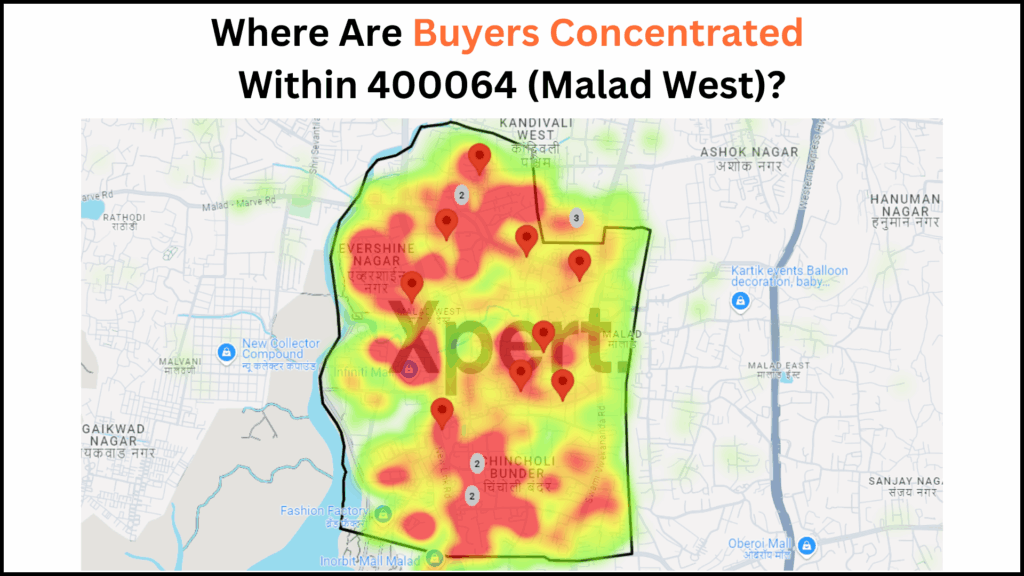

- Mapped their exact locations (down to lat-long level) to identify the highest concentration zones across 80+ pincodes.

- Matched these buyer-dense clusters to nearby GT stores and checked their local popularity (Google Maps ratings, visibility, etc.).

The outcome? A buyer-anchored report that helps brands take the guesswork out of their distribution roadmap.

What’s Inside the Mumbai GT Distribution Report

This report is a complete distribution playbook for Mumbai. You will find:

- The top GT stores in each pincode based on proximity to high-buyer-density zones

- A list of residential societies that drive demand, perfect for BTL or sampling programs

- Buyer density scores that tell you which areas give the highest return per sq. km

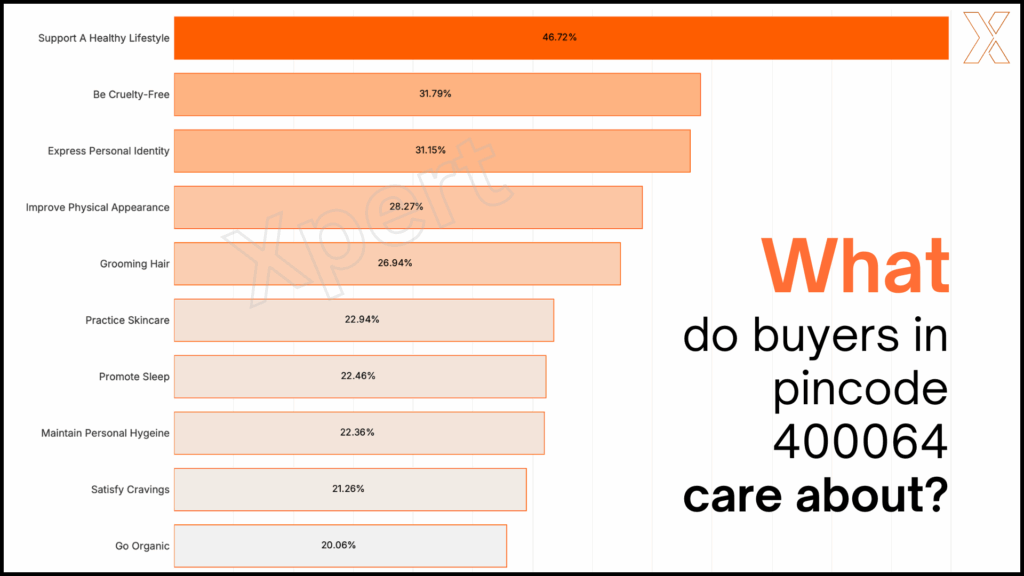

- The dominant shopper identity traits in each zone—appearance-focused, family-driven, health-first, and more

- Category preferences by region—so you know what to stock where

Whether you’re launching a new SKU or expanding shelf presence, this report gives you location-level clarity.

Key GT Hotspots in Mumbai

Let’s look at three buyer-dense zones that emerged from the report:

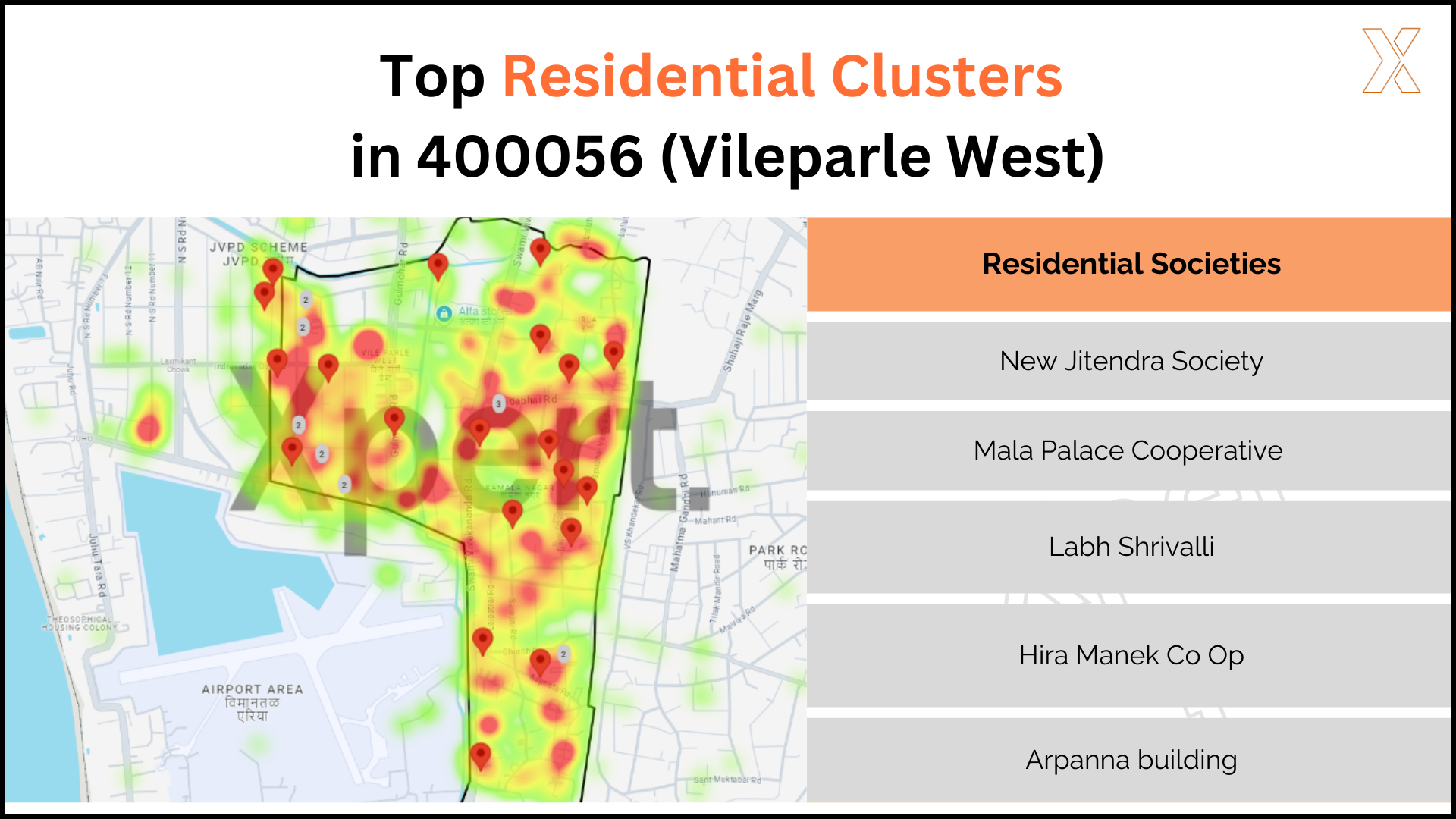

1. Vile Parle West (Pincode 400056)

Top Residential Societies:

- New Jitendra Society

- Mala Palace Cooperative

- Hira Manek Co-Op

- Labh Shrivalli

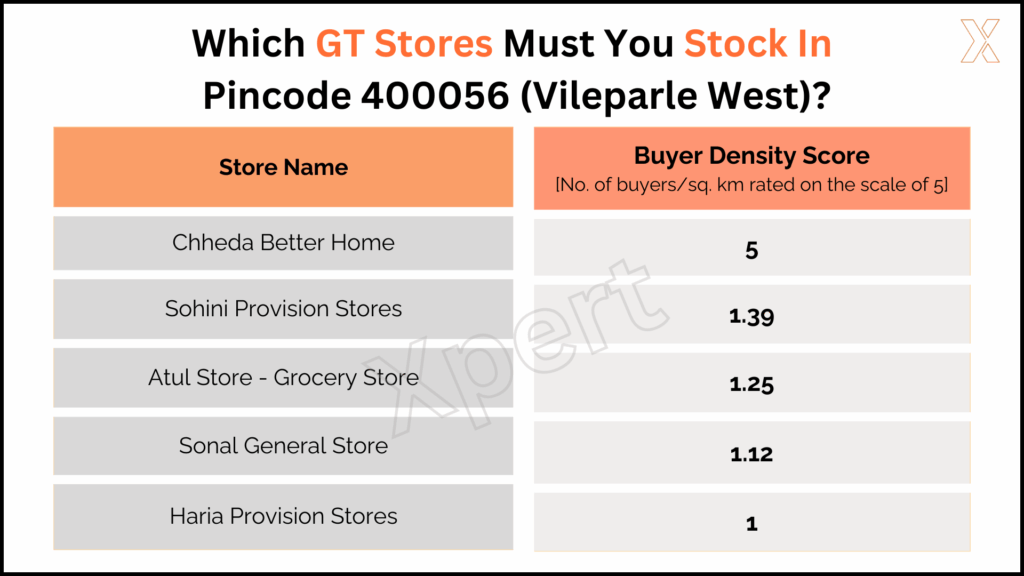

Top GT Stores Nearby:

- Chheda Better Home (Buyer Density Score: 5.0)

- Sohini Provision Stores

- Atul Grocery Store

- Sonal General Store

- Haria Provision Stores

Popular categories here include mid-premium grocery, personal care, and daily-use FMCG.

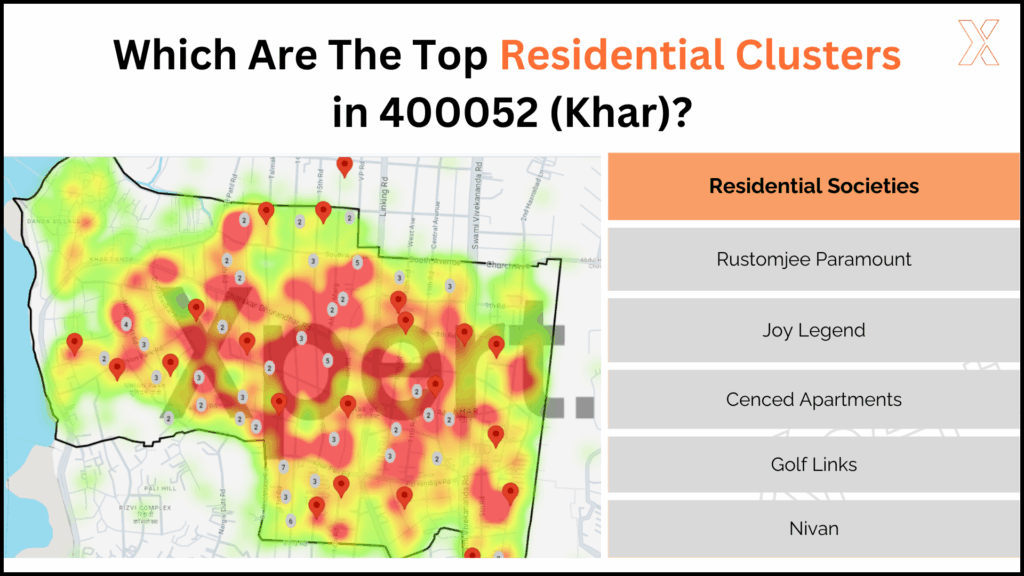

2. Khar (Pincode 400052)

This area blends legacy affluence with newer luxury buyers.

Top Societies:

- Rustomjee Paramount

- Joy Legend

- Golf Links

- Nivan

Top GT Stores Nearby:

- Shri Vishnu Stores (5.0)

- Shivam Store

- Neelam Foodland

- Famous Stores

This zone is a strong fit for gourmet, health, and skincare brands looking for value buyers who also care about quality.

3. Malad West (Pincode 400064)

A high-footfall, high-density residential hub with younger, brand-aware buyers.

Top Residential Clusters:

- Interface Heights

- Rustomjee Elanza

- Auris Serenity

Top GT Stores Nearby:

- Gajanan Super Market (5.0)

- Sweet Home Super Market

- Jem Dal Mill

- Patel Super Mart

This region is great for brands targeting everyday essentials, packaged foods, snacks, and beauty products.

Why This Report Goes Beyond Store Lists

Most GT plans are built on distributor insights, anecdotal retailer feedback, or past campaign performance.

We think there’s a smarter way.

This report helps you:

- Avoid over-distributing to low-return stores

- Focus stocking on GTs that serve actual buyer-rich pockets

- Customize category mix by neighborhood

- Target housing societies directly for BTL, sampling, or promotions

By working backward from verified buyer behavior, you’re not just reaching stores—you’re reaching the right buyers through the right shelf.

How This Report Helps FMCG, Grocery & Essentials Brands

If you’re scaling distribution in Mumbai, this report helps you:

- Identify top GT stores per region based on actual buyer demand

- Pinpoint high-density buyer societies for outreach

- Match local identity traits to your product positioning

- Reduce stocking errors and improve sell-through velocity

And if you’re launching a new line? Use this to pilot where demand already exists.

Get the Full Report

The Mumbai GT Distribution Report 2025 includes insights from over 6 lakh buyers, across 500+ brands, covering 80+ pincodes in detail.

You’ll get:

- High-conversion GT store recommendations

- Buyer-rich micro-market maps

- Real category and identity insights to inform marketing and stocking

About Xpert

At Xpert, we help brands grow smarter by tracking 12M+ verified buyers across India and turning their purchase behavior into distribution, marketing, and media strategies.

We help brands:

- Identify where buyers live

- Understand what they buy

- Choose the right stores, neighborhoods, and channels

Explore more at www.xpert.chat