Malls today face a new challenge.

It’s no longer enough to have big brands and high footfall.

To outperform, a mall must do one thing right:

Attract the right kind of buyers.

So we set out to ask:

What really makes some malls high-conversion destinations—while others in the same neighborhood struggle?

To answer this, we ran a deep-dive Catchment Analysis around one of Delhi’s most prominent malls—Select City Walk—to understand what sets it apart.

How We Built This Catchment Report

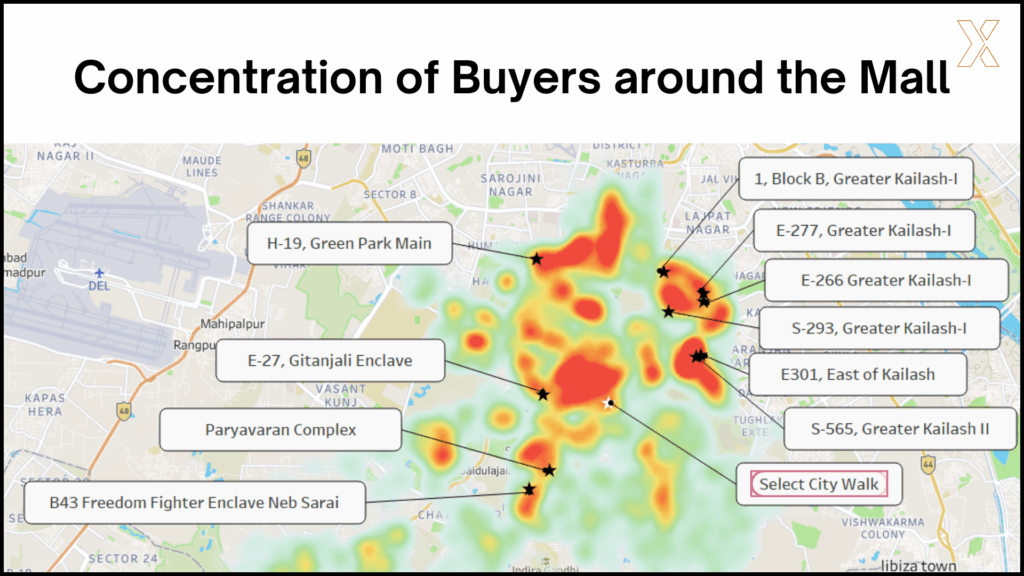

We tracked 122,000+ buyers residing within a 5 km radius of the mall, analyzing their omnichannel purchases across 500+ premium brands—from apparel and home décor to food, grocery, and wellness.

Then we matched these findings against the mall’s brand mix and buyer alignment, asking:

- Who actually lives around the mall?

- What are they buying—and why?

- How well does the mall’s brand assortment reflect local demand?

What we uncovered paints a clear picture of why some malls thrive: they mirror the psychology, lifestyle, and expectations of the buyers they serve.

Select City Walk: Perfectly Positioned for Buyer-Brand Fit

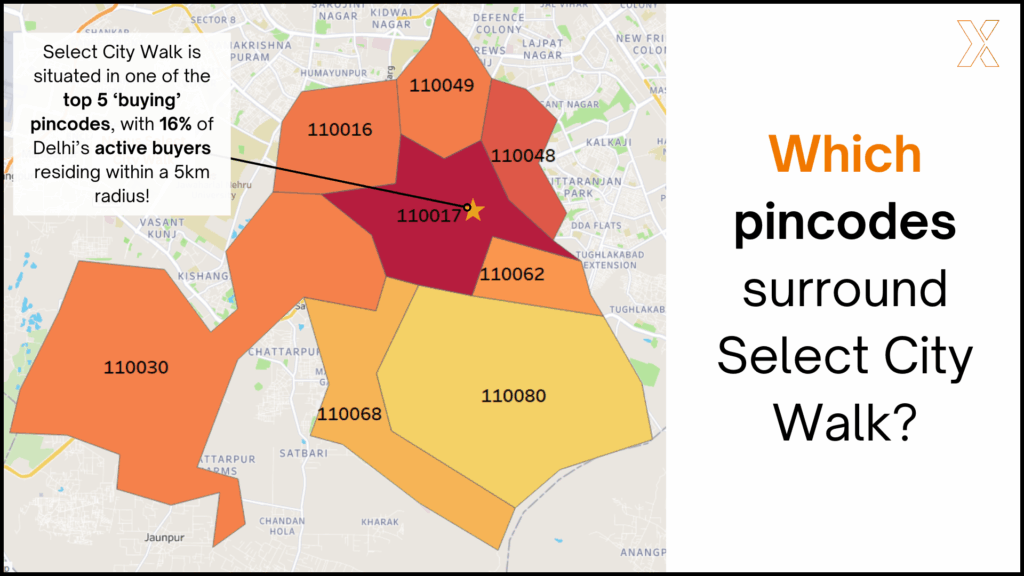

Located in one of Delhi’s top 5 ‘buying’ pincodes, Select City Walk is surrounded by localities like Greater Kailash-I & II, East of Kailash, and Green Park Main—zones known not just for affluence, but for taste-driven, lifestyle-focused consumers.

Here’s what we found:

- The mall’s 5 km catchment holds 16% of Delhi’s active shoppers—making it one of the city’s richest zones in buyer concentration

- Neighboring malls like Metropolitan MGF and Southern Park Mall don’t share the same demand density or buyer alignment

- And it’s not just footfall—it’s the quality of buyer intent that makes the difference

Buyer Psychology: Who Shops Here—And Why?

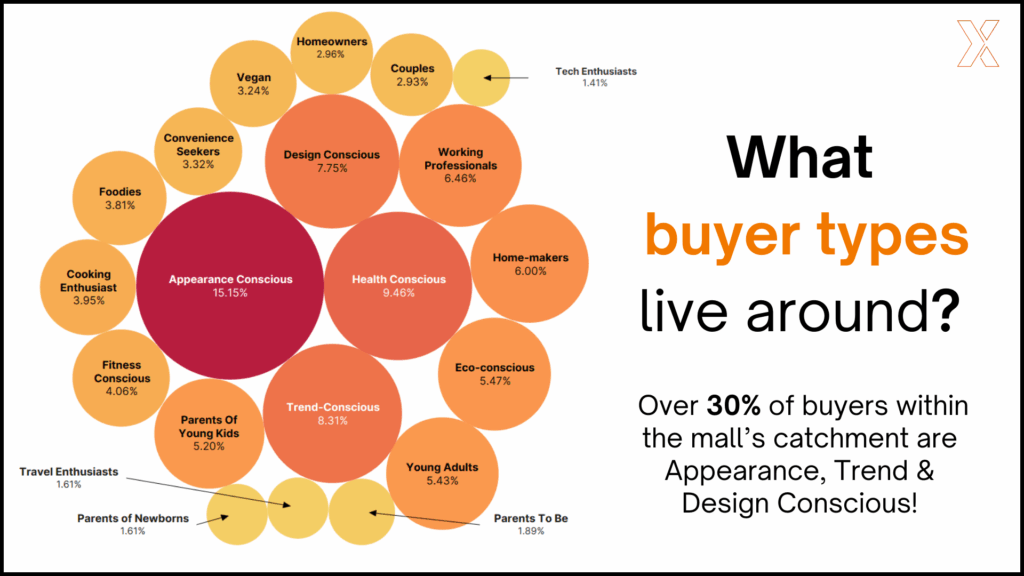

Over 30% of buyers within Select City Walk’s catchment fall into three high-intent categories:

- Appearance Conscious (15.1%) – buyers who prioritize grooming, fashion, and aesthetic appeal

- Trend Conscious (8.3%) – early adopters who respond to new launches, limited collections, and seasonal promos

- Design Conscious (7.6%) – consumers who care about curation, store ambiance, and product visual appeal

Other emerging traits include:

- Parents of Young Kids (5.2%) – drawn to safety, convenience, and quality brands

- Fitness-Conscious Buyers (4.1%) – interested in wellness, organic, and active lifestyle categories

These insights are behavior-based—not inferred from demographics or surveys, but based on actual buyer transactions across categories.

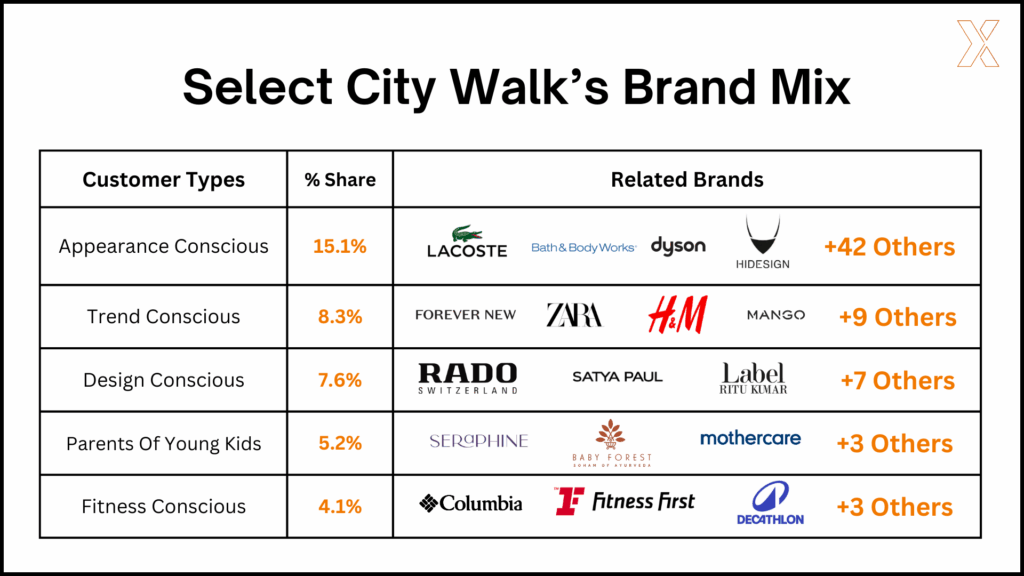

The Brand Assortment That Matches Buyer Intent

The mall’s tenant mix is clearly built around these traits.

From Zara and H&M to Dior, Chanel, Forest Essentials, and Theobroma—the brands here reflect the identity of the people around it.

This alignment between buyer psychology and store selection leads to:

- Higher conversion rates per visit

- Greater repeat engagement

- Stronger brand lift and in-store discovery for new launches

It’s why Select City Walk isn’t just a mall—it’s a curated ecosystem that mirrors its buyer base.

What Are Catchment Buyers Actually Shopping For?

Our buyer intent data reveals that these shoppers show higher-than-average engagement in:

Fashion & Accessories

- Premium western wear

- Statement jewellery and minimal accessories

- Seasonal drop and collab collections

Food & Beverages

- Gourmet snacks and beverages

- Boutique cafés and experiential dining

- Health-focused QSR options

Home & Wellness

- Home décor, aromatherapy, and candles

- Personal care and wellness bundles

- Organic and clean-label brands

This is not a price-sensitive crowd. They’re quality-focused, expressive, and exploratory buyers who respond to brand narrative and product storytelling.

How This Report Helps Malls & Retail Brands Expand Smarter

This isn’t just a mall audit—it’s a framework for evaluating any retail destination based on real buyer demand.

For brands, this report helps answer:

- Does the mall’s catchment align with our target buyer’s mindset?

- Are we competing with the right brand neighbors for attention?

- Will we drive conversions, or just visibility?

For mall developers and leasing heads:

- Are we curating stores that reflect the true buyer DNA of our location?

- How does our catchment compare to other malls in the vicinity?

- Where should we invest next based on buyer density and psychological match?

What’s Inside the Full Report?

Our 15+ slide Catchment Intelligence Report for Select City Walk includes:

- Top-performing pincodes, localities and societies fueling the mall’s buyer activity

- A breakdown of dominant buyer identities in the 5 km catchment

- Purchase insights across fashion, food, décor, and wellness

- Comparative insights against neighboring malls to evaluate relative positioning

Final Word: Buyer Match Is the Real Retail Moat

Select City Walk’s success is no accident.

It’s driven by a deep match between buyer identity and retail experience.

As Indian retail evolves, this kind of catchment intelligence is no longer optional—it’s essential.

Download the full Select City Walk Catchment Analysis Report

About Xpert

At Xpert, we help India’s leading retail brands, malls, and media teams grow smarter by tracking 12M+ verified buyer journeys across 500+ omnichannel brands.

From catchment evaluation to buyer-led expansion strategies, we help you:

- Target high-conversion zones

- Launch where the demand lives

- Build your next store, not just in the right city—but in the right neighborhood

Explore more at www.xpert.chat